Why We Don't Save #3: "I make enough money - I don't need to budget."

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Welcome to our series: Why We Don’t Save – a breakdown of the six most common reasons people put off starting their financial journey.

Are they legit? Do you feel personally attacked? Stay tuned for a new post in this series every month!

Budgeting isn’t just for the financially strapped. It’s for anyone who wants to do something with their money.

Oh, have I described everyone in the entire world?

“Look, I don’t need a budget, okay? I make enough. I don’t worry about money. I can save plenty just by spending a little less. Don’t make this a thing."

-You, maybe.

I get it, I really do. Budgeting looks like a lot of work. When you feel like you’re doing just fine – why fix what’s not broken?

The truth is that you’ve been lulled into a false sense of complacency – exactly where the marketers and salesmen of the world want you to be.

The money you may be squandering on things you actually hate could fund your next trip to Bermuda, or your child’s education.

Let me explain.

It’s not how much you’re saving, it’s how much you’re wasting.

You know there’s extra money in there somewhere. You fully admit that you’re not spending every dollar optimally – hence the desire to cut back somewhere, but the lack of desperation or urgency.

But while you’re spending in relative blissful ignorance, what you’re missing is the moral outrage over the rest of your missing money. For years you lived on a fraction of what you currently make – so where does it all go?

The median household in the United States has an annual income of just over $60,000, but a total savings of only $11,700. This includes lawyers, teachers, retirees (some with dragon’s nest eggs), homeless, Wall Street executives – and you.

In 2019 alone, the average American spent:

- $55.32 on ATM fees

- $161.64 on monthly account maintenance fees

- $225 on overdraft charges

- $44.60 on paper statement fees

That’s $486.56 on fees just associated with keeping an account open. Meanwhile plenty of banks offer free ATMs, overdraft protection, digital statements, and no-fee accounts. It almost seems like you've wasted $486.56 just by not paying attention.

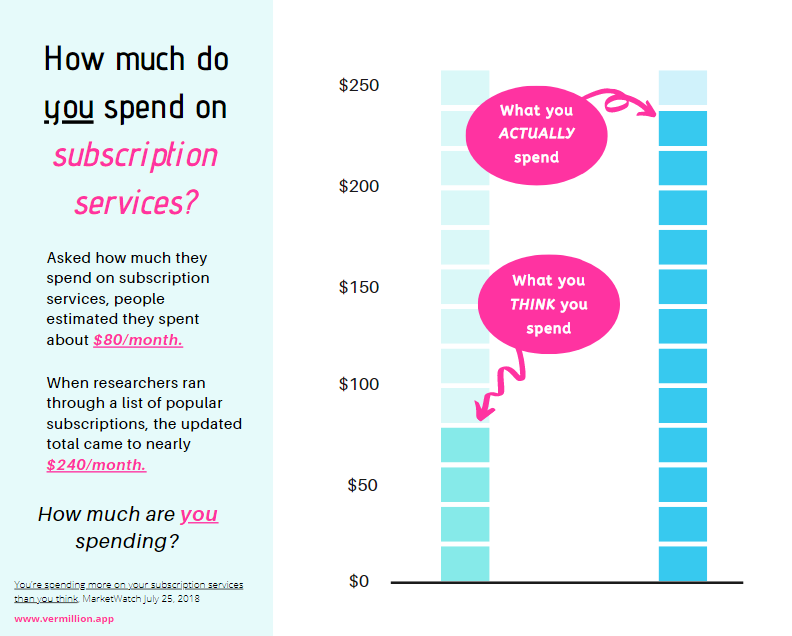

People also hugely underestimate how much they’re spending on subscription services. Often by as much as hundreds of dollars.

How is this possible?

Many people who “aren’t struggling” just aren’t thinking about it. What doesn’t get tracked, doesn’t get noticed. And you can’t act on what you don’t see.

Like karaoke night at your favorite bar, banking fees have a way of making even longtime customers head for the exits.

But there’s a difference between saying you’ll leave your bank and actually doing it… Not sure where to start? Here’s a rundown of what you’ll need to do when you’re ready to say goodbye to your old savings and checking accounts.

How to switch banks in 6 simple steps (Bankrate)

But where does it go?

Think about it. If you’re “not struggling” you probably earn around $60,000/yr and take home around $45,000/yr – about $3,750/month. Let’s say your housing is $2,000/month.

Insurance might be $150, and on average food might be $300. Let’s kick in $200 for gas and insurance.

That leaves $1,000.

What are you spending $1,000 on every month?

- A new iPhone?

- A trip to the Carribean?

- $12 avocado toast at every meal?

- A pumpkin spiced latte every 3 hours???

And that’s not one month. Not three months a year. Every. Month.

And some of you are making much more than $60,000/year. Where on earth is it all going??? Since you aren't tracking your spending, you may never really know.

Especially if you make a habit of spending cash.

It’s extremely easy to forget what you spent and why. You had $50 yesterday and $20 today. Did you pay back your friend, buy dinner, go shopping…?

Why An All-Cash Budget Is A Bad Idea (And What To Do Instead)

The point is: We all know what we would do with a couple extra dollars – even if it’s just adding to our savings or emergency fund. You may not be worried, but you also may not be maximizing the value of your money.

Maybe that $161.64 you spent on account maintenance fees could buy you eight new books, or feed someone less fortunate.

Wouldn’t you rather determine where your money goes?

Sometimes we want to spend more on the important things. These things often embody our personal values, like supporting our children’s education or giving charitably. Even if you’re not struggling to make ends meet, budgeting can help you spend more on the things you value by focusing your money where it matters most.

6 Reasons to Budget (Even if You’re Not Struggling)

Budgeting isn’t really that much work.

Our budgeting system only takes 2 minutes to set up, and balancing an existing budget can take as little as a few minutes a month.

Even when I go months without updating mine, it only takes me a maximum of one hour to log all of my expenses. That’s one episode of a show.

The barrier holding you back isn’t time management – it’s emotional competency. Facing our finances is a tricky topic, even in private. But taking action is the best way to build stronger habits and more confidence.

And there are plenty of other benefits that have nothing to do with money.

Engaging in neutral money-talk with your partner can help ease tensions and strengthen your relationship.

5 Benefits of Budgeting That Have Nothing To Do With Money

Corporations don’t want you to budget.

They want you to spend mindlessly. They do not want you to question where your money is going.

Even seemingly consumer-friendly companies like Intuit (makers of the famed TurboTax), have been embroiled in scandals related to fleecing consumers for unnecessarily pricey products. (Did you know they own the money-management company Mint? Yep.)

(Side-note: We’re Vermillion. We’re FREE. And we’re not trying to fleece you.)

So if you think you’re too good for a budget – think again! Even if you’re not paying attention, someone else is. And whoever watches the money decides how to spend it.

Related Posts

3 Types Of Lifestyle Inflation (And How To Beat Them)

How To Budget-By-Paycheck