How To Budget-By-Paycheck

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

If you’re living paycheck-to-paycheck, budgeting paycheck-to-paycheck is a must.

And you’re probably already doing it.

“Rent is paid with the first paycheck, plus a little leftover for food. Then the second paycheck pays the rest of the bills… and savings is whatever’s leftover."

-You, definitely.

Budgeting by paycheck is how most people tackle their monthly expenses. It helps them separate what they can pay, when they can pay it, and where the money will come from.

To really squeeze the value out of a budget like this, you should combine it with zero-sum budgeting – the core principle behind Vermillion! A match made in heaven.

The Perfect Savings “Hack”

The Perfect Savings “Hack”

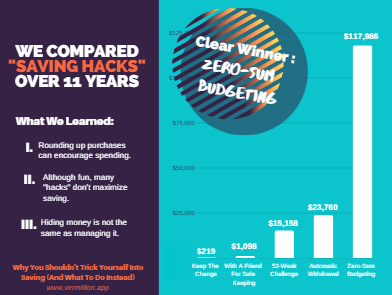

We compared different savings methods and found a clear winner – zero-sum budgeting!

It was 5x more effective than the next leading strategy.

Why You Shouldn’t Trick Yourself Into Saving

Whether you’re a seasoned pro at budgeting by paycheck, or you could use a little help – it’s one of the most effective tools out there to squeeze every cent out of your income.

Fixed, Flexible, Future & Savings

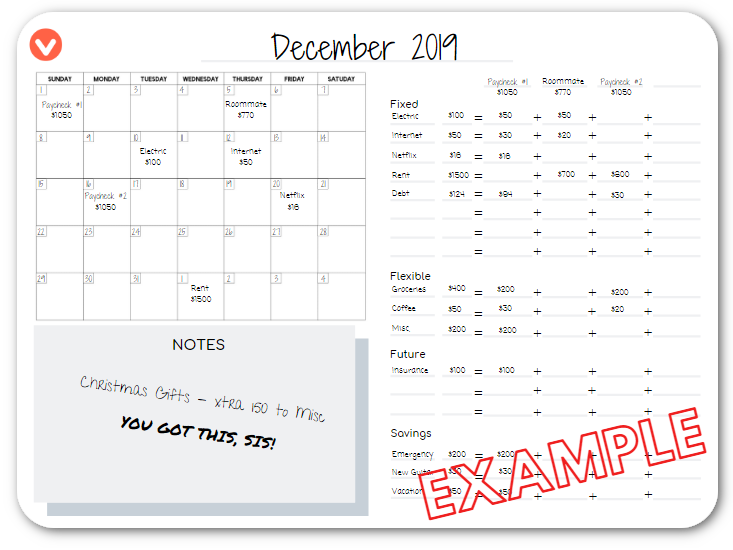

Most people who budget by paycheck only include one F: Fixed Expenses. They often forget the flexible expenses (groceries, daily coffee) and future expenses (quarterly or annual bills). They almost never include savings.

To truly take control of your money, you’ll need all four.

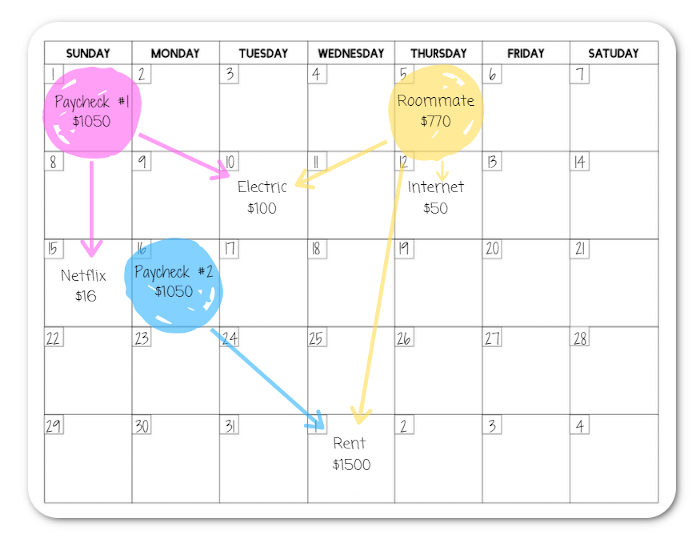

A calendar can help you visualize when your money is coming in – and when it’s going out. You can mark the date of each paycheck and bill, as well as plan your flexible spending – schedule your grocery trips, track your daily coffee, etc.

Ready to see it step-by-step?

-

First, determine how much money you’ll be working with. Write down each paycheck on the date it will occur.

-

Next, mark down all of your fixed bills on their relative due dates. This is the date you’ll be paying the bill.

-

Connect each bill to the paycheck it will be paid with – either with a line, or color-coding, or both!

But it’s hard to record flexible and future expenses this way. And how on Earth should you schedule savings on a paper calendar??

This is where you’ll want to go the extra mile.

Make a list of all your budget categories (including fixed bills), and create a column for each paycheck (or other income source). Next to each category, you can list how much of each paycheck will go toward that spending. This way you can easily add up the totals to make sure every dollar gets a job, and every bill gets 100% covered.

Don’t forget next month!

If you have any money leftover, consider putting it into a buffer fund. Once you’ve saved up one month’s worth of expenses, you can budget a whole month ahead and break out of the paycheck-to-paycheck cycle.

It’s life-changing. Trust me.

Just because it’s simple doesn’t mean it’s easy! In fact, getting one month ahead of your expenses can be the most confusing part of budgeting for many people.

How To Get One Month Ahead

Where paycheck budgeting fails…

If your income varies a lot every month, this method may not be for you. It can be difficult to plan your expenses around an income with extreme ups and downs – but it can be done!

Whether you’re hourly, working odd jobs, freelancing, or working on rollercoaster commissions – you can make a budget that works.

How To Budget With A Variable Income

Paycheck budgeting also works best when you can accurately estimate your spending (more or less). If you really have no idea how much money you’re spending every month, you should start by tracking your expenses for a few weeks.

Give it a try!

Over time you’ll find a rhythm that works for you and builds awareness around your income and expenses.

Related Posts

Recovering a Neglected Budget

How to build your first budget