6 Reasons to Budget (Even if You're Not Struggling)

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

We always talk about spending less.

But why?

Sometimes we want to spend more on the important things.

These things often embody our personal values, like supporting our children’s education or giving charitably. Even if you're not struggling to make ends meet, budgeting can help you spend more on the things you value by focusing your money where it matters most.

So before you look down your nose at actively managing your money, think about these six reasons to be more mindful.

1. Set aside money for charitable causes

The internet has made it easier than ever to connect with organizations and individuals in need.

If you feel strongly about a particular cause, why not set aside money every month to support it? This is an expense that you can feel warm and fuzzy about.

Every week I see posts from people in need on GoFundMe and similar websites. I can’t imagine the suffering that people go through before they have the guts to ask for help. Imagine how they would feel if you kicked in even a small amount of money to help them out.

Now imagine being able to do it guilt-free, knowing your budget will be just fine.

2. Stop spending on harmful things

Don’t be complicit! There are tons of opportunities to “vote with your dollars” and support cleaner infrastructure. Or maybe you want to limit spending on something you hate, like ATM fees.

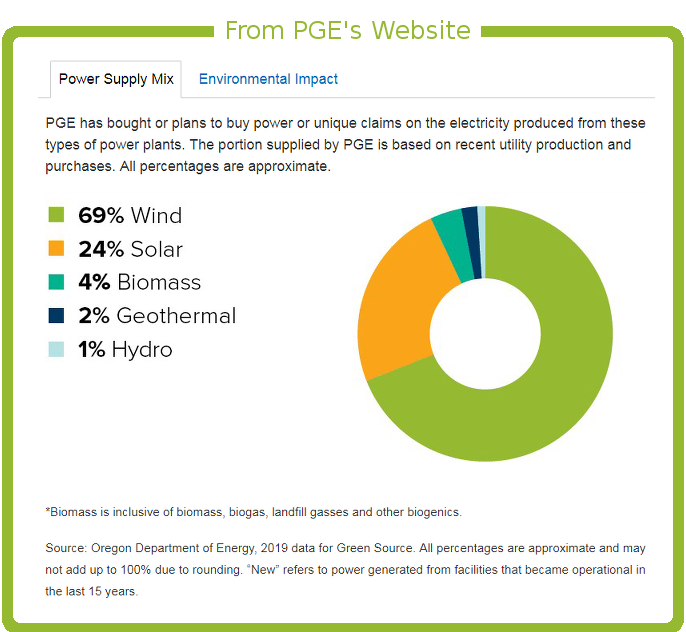

Pay extra for eco-friendly options

For $6/month extra my local power company will pledge to cover 100% of my energy usage with renewable resources like wind and solar. While I do try to minimize my energy usage, this extra cost isn’t due to an increase in energy usage. This is an extra cost I’m happy to bear.

Curb your bad habits

Budgets come in all shapes and sizes. When I was in college, I noticed a particular trend in my spending and acted accordingly.

I created a pizza budget category.

I lived so close to the university that delivery was easy to take advantage of. But I also felt stressed out all the time and knew that my poor diet wasn’t helping, so I limited myself to $40/month.

3. Practice gratitude

If you’re reading this on a computer or cell phone in the United States, you’re likely one of the richest people in the world.

According to the Washington Post, a typical American earns 10x more than the median global income, even after adjusting for cost-of-living.

The average U.S. resident estimated that the global median individual income is about $20,000 a year.

In fact, the real answer is about a tenth of that figure: roughly $2,100 per year.

Similarly, Americans typically place themselves in the top 37 percent of the world’s income distribution. However, the vast majority of U.S. residents rank comfortably in the top 10 percent.

Many people around the globe live on less than $2 a day, and we have trouble spending less than $200/month on food?

It never hurts to take a moment to appreciate our good fortune. If you have enough money to cover all of your needs, you’re one of the fortunate.

Budgeting is a great way to stay mindful of your spending – and mindfulness is a step on the way to gratitude. Every expense you record is another opportunity to appreciate the good fortune you have of being able to afford it.

4. Tithing (if that’s your thing)

Some religious institutions ask their members to donate a percentage of their income. This goes toward overhead expenses of the larger organization, as well as programs for their members who may be in need.

A church in my neighborhood regularly sponsors families transitioning out of houselessness.

If tithing is something you’re into, you can certainly budget for it!

5. Fund small-timers

Friends, creating is hard.

If you see someone creating something you enjoy – consider supporting them! Be sure to check their website – they may have a PayPal or Ko-Fi donation button. You can find tons of opportunities on Kickstarter or Patreon.

6. Save more. No, really.

Even if you’re not struggling, who couldn’t use a few extra bucks in their retirement account?

If you’ve already maxed out your 401(k) contributions…

- Congratulations!

- Think about starting an all-purpose investment portfolio.

- Or a Roth IRA!

- Or save up for a downpayment on a rental property!

The point is, there is always more that we can be doing. But don’t get overwhelmed! First, give yourself a pat on the back for coming this far. Then just take one more step forward.

Bottom line

By forcing yourself to think about where your money is going, you'll create room in your mind to decide where you want it to go. Budgeting is an excellent tool to help you be more mindful with your money!