Recovering a Neglected Budget

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Depending on how long you’ve neglected your budget, it could be a simple fix to bring it back up-to-date. If you’re coming back after a long haitus, you may want to reset and start over. You already have practice building a budget, after all!

The Quick Fix

Inevitably you will fall out of sorts with tracking your expenses – no big deal! While it’s helpful to track your spending in-the-moment, you can always sit down and reconcile your transactions later.

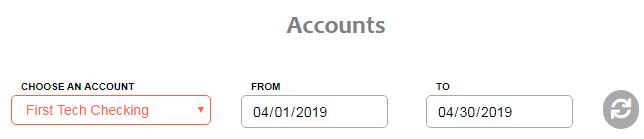

- Sit down with a glass of wine and bring up the Vermillion Accounts page.

- Go to your bank’s website in a separate window.

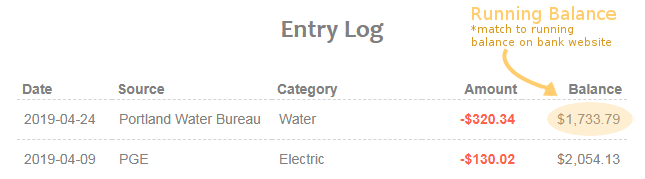

- Do the balances match? If so, you’re probably up to date! Hurray! You may still want to peruse the two lists to be sure.

If the balances do not match, you'll have to compare the transactions.

- Go back to the last time you remember your budget being up-to-date. You can verify using the Running Balance. You can compare the Running Balance next to each transaction to the one next to the same transaction at your bank to find a good starting point.

- Go up the list and verify that each transaction is in both systems.

Sometimes we just forget to enter things, but there are other easily fixable slip-ups:

- Entered the wrong date

- Specified the wrong account (check the other accounts for errant entries)

You’ll want to do this for each account. Once the accounts are up-to-date, go back to the budget and clean things up by covering overspent categories.

The “Adjustment”

If there are just too many transactions to go through, you may want to create a miscellaneous category and just lump everything in there. I optimistically have one called “BookKeeping”.

Calculate the difference between your account balance in Vermillion and the account balance at your bank. Make one large transaction for the difference and categorize it into your new category.

The Full Reset

When you’re just ready to cut ties and start over, you can use the Reset button in your account settings.

This will clear out all the accounts, transactions, and budgeted amounts. It won’t delete your categories – to do that, you can merge categories by renaming them.

Fun Fact: When I was first learning to budget, I quit and restarted three times before the habit began to stick.

It takes a little work, but it’s well worth it! Budgeting only works if it’s working for you.

Related Posts