How To Budget While Broke

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

First-time budgeters often fall into this trap.

It’s Sunday night. You sit down at the kitchen table with a glass of wine and a box of receipts.

You make a list of all your monthly bills – rent, internet, phone.

Then you think about how much you need for those squishier things – groceries, electricity, gas.

You’re on a roll! It adds up to a lot, but you now have your monthly budget! Move over antioxidants, there’s a new miracle in town.

Time passes.

At the end of the month you revisit your budget. Total up your spending.

Not only did you overspend, but now you have $112.40 in additional credit card debt.When you first start budgeting, it’s extremely tempting to budget out every category, complete with every bill you need to pay for the entire month.

This is great – if you have enough money to cover everything. If you don’t, you’ll wind up overbudget pretty quickly.

But don’t panic!

Budgeting without a month’s worth of money in the bank can be done. It just takes a few extra steps. And if you’re running close to empty, you’ll be glad you took the time to make a plan of attack.

The instinct to list everything out is a good one. But if you stop there, you’ll be in for a world of frustration and disappointment when you struggle to pay your bills. Instead you need to focus on prioritizing what you can pay and when.

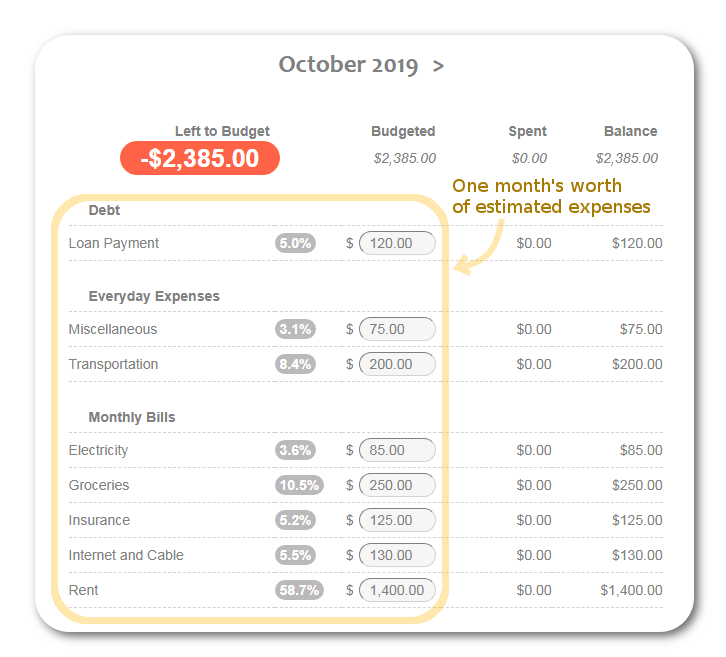

1. List out your expenses

Create a list of your spending categories and roughly how much you expect to spend in each one. Don’t worry, the magic trick is coming soon.

You’ll be in the red, but don’t worry.

Take a screenshot or write down the categories and their budget amounts. This will be a reference.No idea what you spend?

If your money comes and goes in a blur each month, it’s a good idea to sit down and look over your online banking transactions. This isn’t fun, but it will help.

If you’re one of the 24.2 million underbanked people in the U.S., you may be dealing primarily with cash, which can make tracking your spending history tricky.

If this is you, it’s extra important to start recording your income and expenses. Start your budget with some rough guesses and focus on recording each financial transaction for the first month.

2. Prioritize

Not all spending is created equal. Go back over your reference list and highlight the categories necessary for survival. For most people, that includes:

- Shelter (rent or mortgage)

- Food (groceries, not social get-togethers)

- Utilities

- Transportation

- Minimum debt payments

Maybe this is your entire list. Maybe there are one or two categories leftover. Whatever your situation, it's okay. You know your situation best and will be better prepared for in-month prioritization after you spend a moment considering the flexibility of your categories.

3. Budget with money you already have

This is the fun part.

Don’t believe me? Good, I was kidding. This is probably going to be stressful. But the more anixety-producing the step, the more impactful it usually is. Don’t back down now!

Once you have a more-or-less complete spending list for the month, you’ll want to verify that you'll have enough money to cover everything – even if you don’t have that money right now.

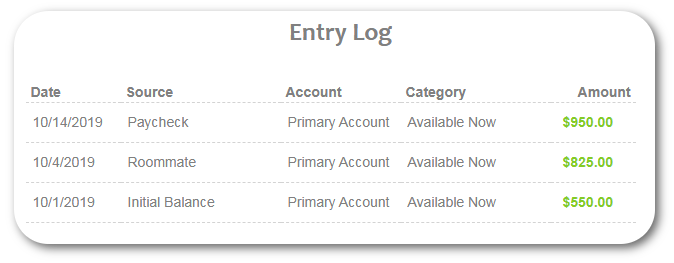

If you’re creating a budget in Vermillion, this is the initial amount you’ll start with. You’ll want to give every dollar a role to play, even if it’s saving up for next month.

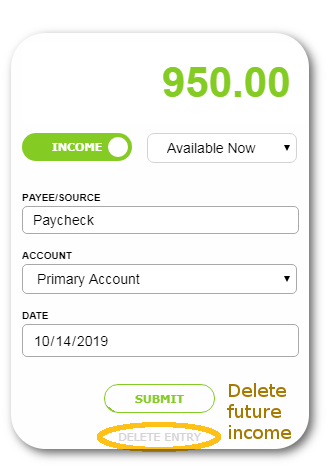

3a. Add future income (temporarily)

With your expenses listed out for the whole month, go ahead and add in any income you’re expecting for the rest of the month. This is money you will be spending, so you might include:

- Your next paycheck

- Rent contribution from your roommate

- Other payments made to you throughout the month

But you’ll probably want to leave out any miraculous lottery winnings – even if you have a good feeling, try to limit yourself to rock-solid planned income that you’ll be able to spend during the month.

That may rule out a paycheck on the last day of the month, for example. We’ll be able to use that money next month, but not this month.

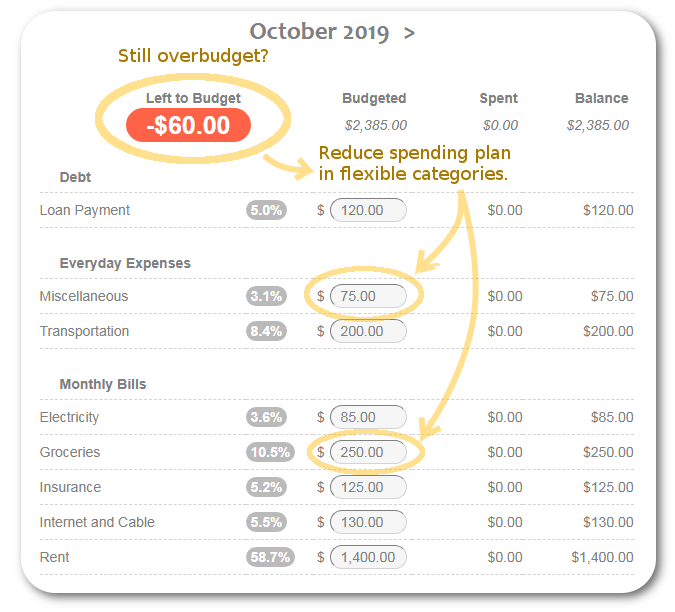

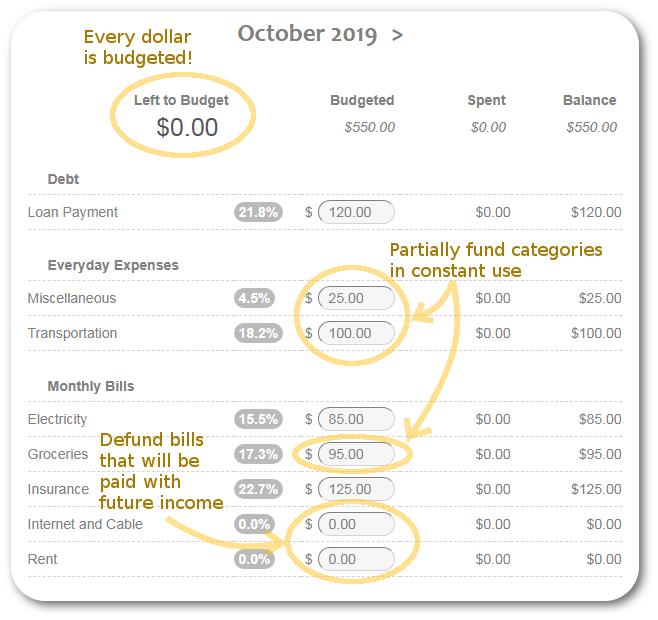

Now look at what’s leftover. If you're overbudget, you need to change your spending plan. Reduce the amount of money in lower-priority categories until every dollar is budgeted – and not a dollar more!

While you’re doing this, make an action list for yourself to help reduce spending in these areas.

The goal is to “budget to zero” – that is, every dollar has a job to do. If you don’t make much money, your budget will reflect that.

It’s not fun, but you may also be able to ask others in your life for help. Showing them a detailed plan for exactly how much you need could go a long way to making it feel less like a handout and more like a hand up.

But we’re not done yet!

Once your spending plan is set up for success, take a screenshot or write it down and move on to the next step.

3b. Remove future income (and budget for real)

Now delete those future income transactions. Although it will come into the picture, you never want to spend money you don't have. You may be paid $1,000 next Tuesday, but if you don’t have it right now, don’t even give yourself the option of spending it.

Deleting your future income will put you back in overbudget territory. That means you’ll need to prioritize what to pay with the money you have right now.

To start un-budgeting, consider bills that won’t be due until after your next paycheck. You can also partially de-fund categories that you’ll be using throughout the month, like groceries – and top them off when you get paid again.

This is also called “paycheck budgeting”. (Or “paycheque budgeting”, depending on where you’re from!)

Once you’ve got your spending plan adjusted, you’re all set!

Be sure to check your budget throughout the month and make any necessary changes. Getting visibility into where your money is going is the first step toward financial freedom, and regaining control over where it goes is the second step.

Related Posts

Case Study: Claire

How To Get One Month Ahead