Case Study: Claire

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

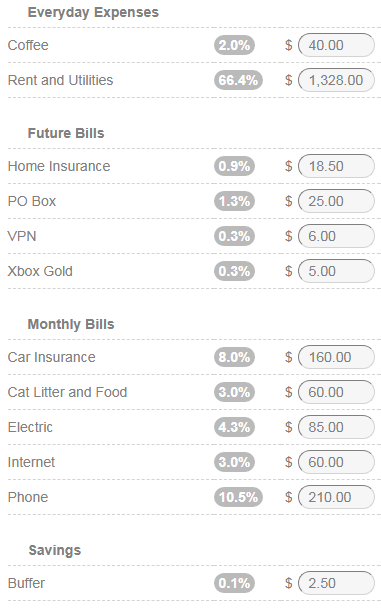

Today we’re hearing from Claire: a 33-year-old Call Center Agent. She shares expenses with her roommate, and ends the month with little to no savings.

Occupation: Call Center Agent

Location: Tualatin, OR

Age: 33

Annual income: $37,000/yr ($18.50/hr)

Typical paycheck: $1,000 twice a month.

Claire says:

Thanks for featuring me! I am a front line phone rep who takes calls by day and reads books by night. My job drives my family nuts because I never make or take calls when off the clock. It’s not my dream job but it’s not too bad most days!

Biggest concerns: I have no savings. If anything happens (and something will inevitably happen to the car/cat/house) I have nothing to fall back on. I’d have to borrow money from family or be late on a bill. That makes me stress when there’s not even anything to stress about.

Biggest goals: Start a credit record, and save up enough to cover at least 6 months living expenses. Owning a place of my own is beyond me, but maybe it wouldn’t be if I could have that stability & a good score in my back pocket!

Most proud of: I’m weirdly good with plants! I don’t have many but the ones I do have thrive.

No Debt

None! My family was amazing enough to help pay for my schooling out of pocket, and we used Pell Grants & the like to cover what we couldn’t. I am very lucky; I know I wouldn’t be able to afford even my small apartment if I had student loans and without my roommate, who actually is the one paying for food and gas for my car.

The part of town I moved to is higher-middle in terms of cost, so we shop at stores in other parts of town to avoid gouging. However, since I didn’t take out any loans in college I have no credit history.Vacation

I try to leave the state at least once every 2 years. Otherwise I get restless and cranky, and then everyone else wants me to leave the state! It doesn’t have to be a big trip either, so a roadtrip for a weekend or flying to Disney World are both satisfying.

Savings

I have no savings. I also have no savings plan, which is pretty clearly the problem. My finances are so tight it’s hard to put aside more than $20 at a time. There is definitely room to improve my budget, but I have trouble maintaining focus at work without treating myself to lunch around once a week to keep my mood & mental stamina up.

Not having a decent savings buffer can be understandably stressful.

But while having a buffer is nice, the best and most sustainable solution is to rework your spending habits to ensure that you always have a means of producing more savings. Focus on the goose, not the golden egg.

Emergency Fund

Six months of living expenses for this budget would be $12,000. If you can lower your expenses, though, then this number becomes lower, too – and more attainable.

Look, I’m not usually a fan of zero-fun budgets, just because I think they’re unsustainable.

That said, if your budget is really tight, it might feel good to do a Buy Nothing week or month just to kickstart your savings.

If treating yourself to lunch is your thing, maybe spend a little extra at the store (ask your roommate!) and eat it in a special location, or make a lunch-from-home date with a coworker.

It might not seem like much, but even a $5 reduction in your coffee budget would mean a 0.25% increase in your savings rate – plus, a $60 reduction in your needed emergency fund.

Additional savings: $5.00

Where To Find More

Since your roommate pays for a big part of your shared expenses (groceries and gas), it might give you peace of mind if she agrees to start her own emergency fund, as well. Having a partner in the race might help ease your stress around money, especially if she can kick in some funds to help.

Additionally, if this is a truly serious goal that would improve your quality of life, consider asking friends or family to contribute in lieu of gifts. It sucks to explain, and it’s not a particularly fun gift, but feeling safe is really an unparallelled present.

Finally, this might be the only time I say this so listen up: A budget may be a raise you give yourself, but a better job is also a raise. You definitely already know this, but I want you to keep it in mind as we tick through your expenses…

Cat Litter

The breakdown here is about $30 for litter and $30 for food. I won’t knock the food choice, although it may be cheaper to order in bulk or subscribe to recurring deliveries online from Chewy.com or Amazon. But I do know some ways to save money on cat litter.

PetSmart sells litter in bulk with re-fillable 15lb and 30lb buckets. The (pre-filled) container itself is usually less than $15 for 30lbs, after which you can refill 30lbs for $10 which could last you 2-4 weeks, depending on your usage. I like this option because it’s a bit cheaper and you accumulate fewer of those giant plastic containers.

The best option, though, is the wood pellet route – which is super cheap if your cat is amenable to it. We did this with our two cats and spend about $5 every other month for the pellets. There is an upfront cost to make or buy the sifting litterbox, but the investment was worth it for us and better for the environment. (And smells better, too!)

Here’s the video that converted me:

Either way, you should be able to save a chunk of cash here.

Additional savings: $20.00

Recurring Expenses

These next three categories make up 19.4% of your budget. It’s worth shopping around once a year to see if you can save some money on auto-pilot.

-

Car Insurance We previously wrote about shopping for car insurance here. If you drive infrequently, you may be able to save more. Tl;dr: check out Root Car Insurance and get $25 off with our referral link.

Savings: $25.00 -

Home Insurance Lemonade is the Root of renter’s insurance. They’re a certified B-Corp (for public benefit), and offer much lower rates than their competitors. They even offer an annual Give Back, donating excess fees to charities of your choice. In 2019 so far they’ve donated over $600,000 to the ACLU, The Trevor Project, UNICEF, and others. I clicked through their pricing and found a policy for $11/month. Savings: $7.50

-

Phone You currently pay for unlimited data for three people, plus payments on a newer phone. It’s still worth shopping around. Verizon lists an unlimited plan with three lines at $135/month, and of course there are bare bones companies like Mint Mobile. With the extra $50/month toward your phone, that could be $185/month. Savings: $25.00

Additional savings: $57.50

Credit History

To start building your credit history, you definitely want to start by taking stock of your current situation.

- Check your score on Credit Karma.

- Read through their report to see if anything needs to be disputed, like purchases or credit cards taken out in your name without your knowledge. Their “recommendations” are often just promotional offers, so don’t feel obligated to sign up for anything additional. But…

- Consider getting a secured card as a precursor to a credit card. You can usually find a local credit union that offers this, for minimal (or no) fees - but you will have to plunk down some money to act as collateral. If you can’t find a fee-free one, consider the fees a payment toward a better credit score.

- Check your new score every month and stay committed to your goals.

The common advice is to avoid debt, but your credit score is a measurement of how you handle debt. Taking on a little bit of debt through a student or auto loan and religiously paying it back can be a good way to improve your score, as long as you don’t go nuts.

Tl;dr: Check your score, get some sort of credit vehicle (credit card, secured card, loan), maintain strict and responsible behavior with it, and have some patience.

Adding It Up

This budget is already pretty sparse, but there’s always a little bit of wiggle room. The real trick is to be on the lookout for opportunities to earn more, save more, and spend less – keeping your goals top-of-mind.

Total Additional Savings: $82.50

Old Savings Rate: $2.50/$2,000 = 0.1%

New Savings Rate: $85/$2,000 = 4.25%

A bump of 4% might not seem like much, but it has the additional effect of reducing your Emergency Fund goal by almost $500.

A little bit of savings can go a long way.

If you’d like to share your budget with our readers, email us at hello@vermillion.app. We’d love to hear from you!

Related Posts

Case Study: George

How To Budget With A Variable Income