Overbudget or Overspending?

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

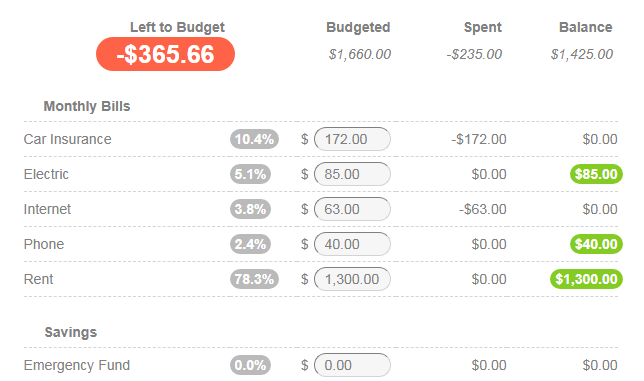

Is your “Left to Budget” in the red? We’ve all been there.

It’s tempting to fund each budget category to the fullest, but if you don’t have money available – you’ll wind up overbudget.

Being overbudget is bad because you can’t tell where the problem is – it’s the whole budget!

This happens when your money is overcommitted.

Overcommitting Your Money

Being overbudget is when you've budgeted more money than you actually have. You know you’ll need money for groceries ($200), gas ($100), and the electric bill ($40), but you only have $95 in your bank account. What do you put in your budget?

If you fund each category based on what you need, you’ll wind up overbudget at -$245. Ouch.

Instead, fund your categories based on what you have. You’ll need to prioritize which categories you will fund and with how much. To prioritize, consider what will happen before you get paid again. Will you need to buy groceries or gas for your car?

When you get paid again, you can add new money into the budget and (hopefully!) fund everything you need to. For now, fund what you can afford to pay, and record what your bills usually cost and when they’re due on paper for reference later.

Covering Overspending

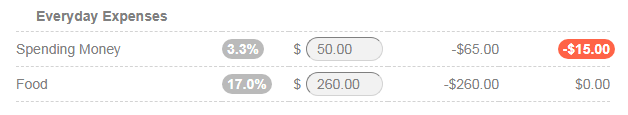

Overspending is a very common problem, and happens to every single person almost every single month. As soon as you notice an overspent category, look at your other categories to see where you can pull from to cover the extra expense.

For example, if my Spending Money category is overspent, I may decide to take some money out of my Food category to cover it.

Without a clear budget, this extra spending goes unnoticed until the end of the month, when we run out of money! This is the real value of budgeting, because now we can make the conscious choice to spend a little less on Groceries in order to keep the money we put into Savings intact!

But what if I can’t cover it?

If you have an overspent category but no money left in your budget to cover it, the negative balance will carry over to the next month. It’s best to cover a negative balance as soon as possible to keep a clear picture of your spending and avoid debt.

Covering overspending can be tricky. Never overbudget to cover an overspent category. Not only are you budgeting money that doesn’t exist, but you’ll lose track of where the problem in your budget is. When choosing how to reconcile a truly messed up budget, always opt for negative category balances when the alternative is overbudgeting.

Related Posts

The Difference Between Overbudget and Overspending

How To Budget-By-Paycheck