How To Get One Month Ahead

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

What would happen if you lost your job right now?

If you have savings to live on while you look for work, then you’re doing better than 80% of Americans. Most people would struggle to pay their bills without their next paycheck. They count on that money.

They have no room in between paychecks for anything to happen.

Hence, living paycheck-to-paycheck.

Breaking the paycheck-to-paycheck cycle

“But isn’t that what money is for?" you ask, “How else am I supposed to pay my bills?!"

The goal is to give yourself some breathing room.

That means decoupling your expenses from your next paycheck. The easiest way to do this is to save up a comfortable buffer to live on – and the simplest buffer to save is one month’s worth of expenses.

Once you get one month ahead, you’ll have much greater freedom to plan your spending. When you have the money up front to plan out your epenses before they happen, you won’t be stuck reacting to unexpected events.

It may take you a while, but the process can be boiled down to three steps: Start saving. Switch your source. Make new money “Available Next Month”.

1. Start saving

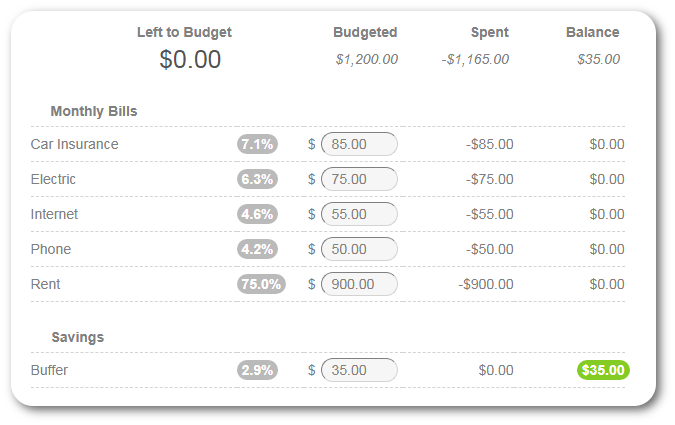

To track your progress in Vermillion, you’ll want a dedicated category. No budget? No problem! Get a refresher here.

Create a new category under Savings. (We named ours Buffer, but maybe you prefer Buffer the Paycheck Slayer.)

Now start saving! Every month, add as much as you can. Over time the balance will get larger. Try not to withdraw money from this category - if you do, the process will take longer.

It’s okay to put only a few dollars in at a time. You can imagine this as putting dollar bills into an evelope for safe keeping. Once the envelope is full, we’re going to use that money!

Keep saving until the balance is enough to cover about one month’s worth of expenses. Err on the side of caution – more is better!Once you’ve saved enough, you’re ready for the next step!

2. Switch your source

This is the step that confuses people. It’s not difficult, but it requires that you pay a little attention to the instructions. Listen up.

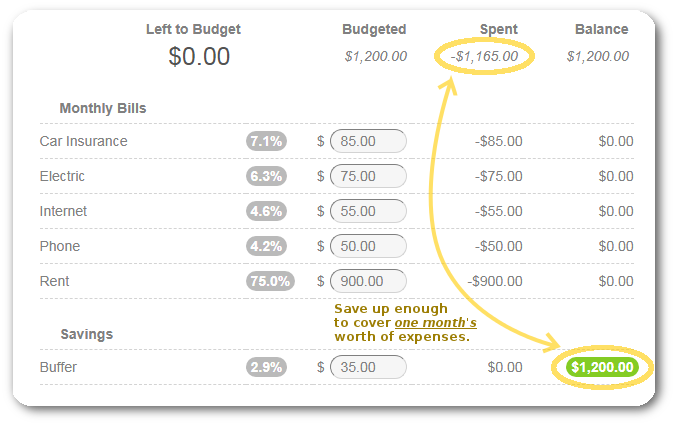

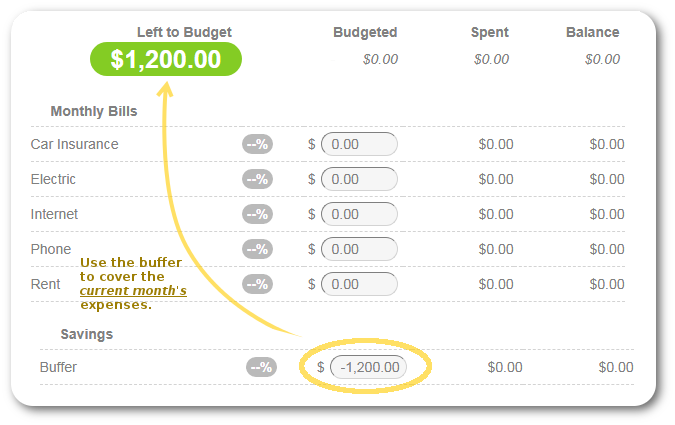

Once your buffer is big enough to cover one month’s worth of expenses, it’s time to do just that. (Cover your expenses, I mean.)

Zero-out the category by entering a negative amount. This will de-fund the balance of that category, and the money will go into your “Left to Budget” for the current month.

Think of this as taking money out of the “Buffer” envelope. For this purpose, you’ll want to take out the whole balance.

Since there should be enough to cover all of the expenses for the month, go ahead and budget all of that money!

3. Make new money “Available Next Month”

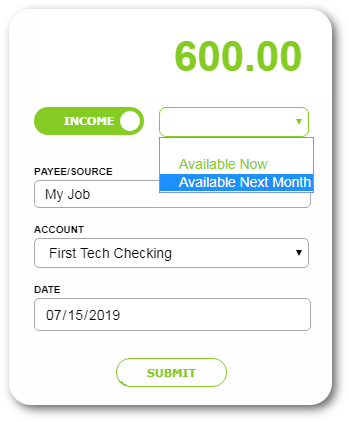

Now that you’re funding the current month using your buffer money, any new income can go towards funding next month.

Rather than socking it away in the Buffer category, you can actually just specify it as “Available Next Month” when you enter it. Vermillion will know what to do!

When next month finally comes, you’ll see a month’s worth of money ready to budget. This is the money you marked as “Available Next Month”.

This way you’ll always be using last months’ income – staying one month ahead of the curve!

Got it? Good.

Frequently asked questions

Just because it’s simple doesn’t mean it’s easy! In fact, getting one month ahead of your expenses can be the most confusing part of budgeting for many people.

If you do it right, though, it can be one of most empowering ways to take your budget to the next level.

Why not just keep the buffer saved and budget this month’s money towards this month’s expenses? What’s the difference?

If you’re using this month’s money to pay this month’s bills, you’ll have to prioritize your categories since you won’t have enough to cover everything in one paycheck.

The beauty of being one month ahead comes in three forms:

- Budgeting becomes much easier. No more overbudgeting.

- No more worrying about bill due dates. You already have the money!

- You’re building your savings habit.

Because you don’t need to prioritize your bills, you can take a step back and think critically. Will you try to spend a little less this month on groceries? Try to save up for a vacation? You have the latitude to be proactive, instead of reactive.

It’s also worth noting the relief you’ll feel from knowing that all of your bills will be paid. And if you suddenly lose your job, you have a month to figure things out.

Why not save more than one month?

Why not, indeed!

Keep as much as you want in an “emergency fund” category. If the time comes, you’ll know how to use it.

What if this month’s income isn’t enough to cover next month?

As you budget your new money towards next month, you might be in trouble if next month rolls around and you actually can’t cover all of your expenses. Oops!

This could happen for several reasons:

- Your income varies wildly month-to-month.

- You hit a particularly large expense.

- Your income is consistent, your expenses are consistent… but you’re overspent or overbudget every month.

We’ll cover budgets for variable incomes soon (#1), and if you’ve just uncovered a big expense (#2) – don’t worry! Move some money around and remember to save up for it next time. Read up on being overbudget and overspent.

Can you do it? Are you ready to (finally) get one month ahead?

Related Posts

How To Budget With A Variable Income

Add A Category