How to build your first budget

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Vermillion budgeting is built on several key concepts that work together to keep you engaged and aware of where your money is going.

Budget to zero

Leftover money gets spent, not saved. Be proactive by budgeting all of your money, down to the last dollar. Even if you put it in a miscellaneous category called “Other”, you’ll start to think about it more over time.

Digital envelopes

The classic envelope method is tried and true, but involves keeping large amounts of cash around the house – yikes! By digitally separating your funds into different spending categories, you’ll keep your priorities straight and avoid overspending.

Awareness

It’s easier to make good decisions when we’re equipped with good information. Each transaction you record helps build a habit of awareness around your budget. That way when you go to spend another $10 at Target, you’ll know whether it’s in the budget or not. And if it’s not, you’ll be able to visualize the consequences – whether that’s a smaller contribution to your emergency fund, less money for food, or a longer wait to buy that special prize you’re saving up for.

The format may challenge you at first, but the pay-off will be well worth it. When you use Vermillion, you’ll learn how to…

- Avoid debt

- Prepare for large expenses

- Align your spending with your values

…and because of our key concepts, you’ll have the added benefits of knowing exactly where your money is going and being able to proactively redirect it.

Let’s get to it!

- Set up accounts

Add any debit, checking, or cash accounts. If you currently have any money in the account, record that initial balance. This money goes into the budget for the current month, where you can specify what that money will need to do. Some might already be ear-marked for a specific purpose.

Add any credit cards, along with the current balances. For example, if the current balance on the card is -$500, you would record that as the initial balance. Vermillion will create a new category for this card’s initial negative balance under Debt.

While you can pay down this initial balance by budgeting money towards this category, new expenses on the credit card should be categorized under their appropriate spending category (Food, World Domination, Dance, etc.) Choosing the credit card as the account on any new expenses is what will keep the card’s balance accurate on the Accounts page.

-

Set up categories Keep it as simple as possible. Resist the urge to make a category for every type of expenditure you can think of. Instead, we recommend creating general categories only when they’re meaningfully different.

-

Fund categories Using the money from your freshly added accounts, determine where your money will need to go. Some will likely go towards bills during the current month. If you have money leftover after that, consider overfunding these categories to get a head start on next month, or building up an emergency fund caregory. There should be no money left to budget.

If you still have excess – start a general savings category or start saving for something big! If you do not have enough money to cover your expenses, you’ll need to prioritize which categories to fund with the money you do have available.

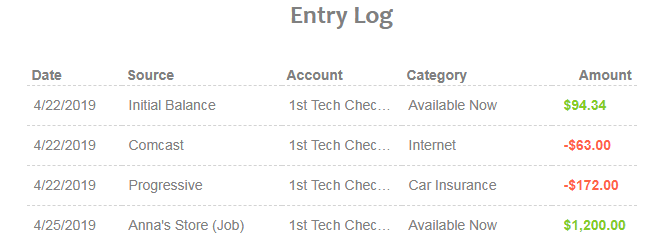

4. Record transactions Throughout the month you’ll spend some money, get paid, and spend some more. Record each transaction as it happens.

- Adjust as necessary Oh no! Did you overspend? Did something unexpected happen? Or have your priorities shifted? You can always move money around to cover overspent categories, but be careful not to overbudget. This is where you’ll start to think about how to drive toward a leaner budget so that you can efficiently fuel your true priorities.

The first month may be rocky, but I encourage you not to give up! People who make it past the three-month mark often find their lives beginning to transform.