Paying Down Debt

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

You have debt!

Yes, you.

How do I know? Because in 2015, 80% of Americans had debt.

And that was freaking 2015.

If you haven’t had it, you probably will. Paying it down can be a frustrating process – we’ll cover how to track your progress with Vermillion.

Getting Started

There are essentially two ways to include debt in your budget.

- As a category

- As an account (with a category!)

You may have noticed – you’re going to use a category either way.

This is because you’ll want to set money aside for payments on your debt. The only question is whether you need an account to go with it.

Debt like mortgages or student loans work well as standalone categories because people don’t use them as accounts to spend money out of.

Credit card debt, however, is created as an account, because a credit card is – well, an account! You spend money from a credit card just like you would from a checking account.

To make things fun, we included a printable tracker to go with your budget at the bottom of this post.

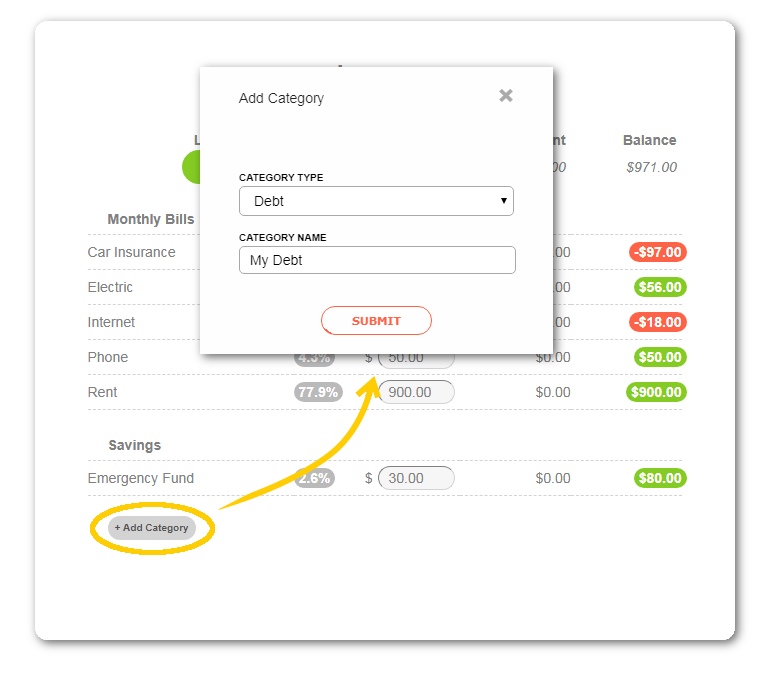

Create a category (recommended)

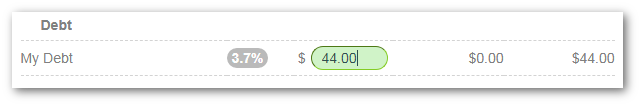

The easiest way to include debt in your budget is with a standalone category. You can then budget your payments like you would budget for any other expense.

- Create a new category, label appropriately.

- Budget money towards the new category.

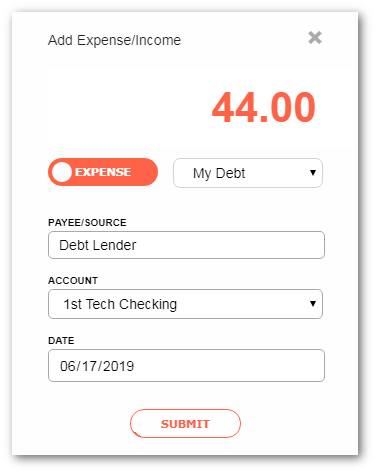

- When you make a payment, record it as an expense.

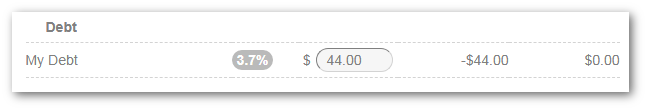

- Celebrate your decreasing debt!

The Good: Payments are recorded just like other expenses. Simple.

The Bad: You will not see the balance of the debt decrease over time. The balance of the category will go to $0.00 every month as you budget your payments and make them.

Create an account

If you’ve added a credit card on Vermillion before, you’ve seen this in action. Credit cards are a specific type of debt – while they may carry a balance that you need to pay off, they also act as accounts that you use to make purchases.

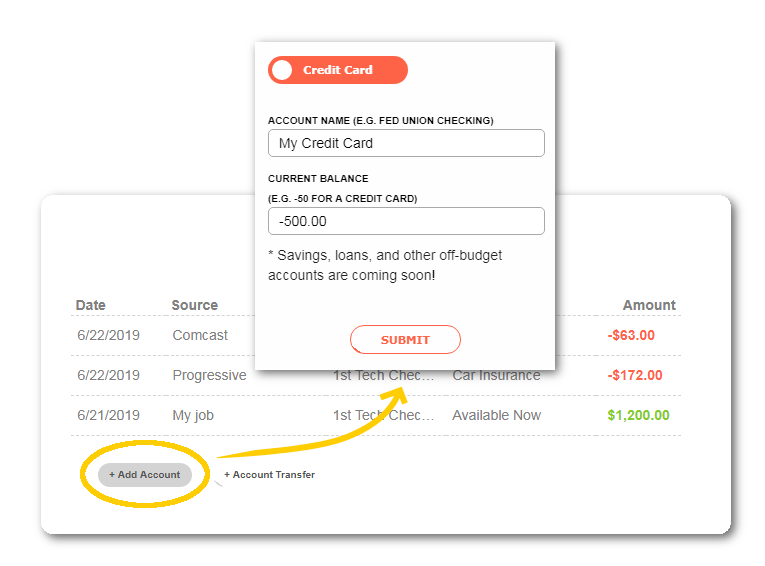

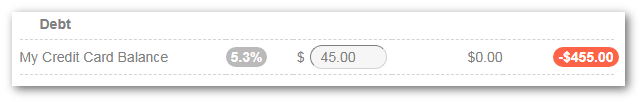

- Create a new account, specifying the negative balance. Once you create a new account with a negative initial balance, a category will be automatically created under the Debt subheader.

- Budget money towards the new category.

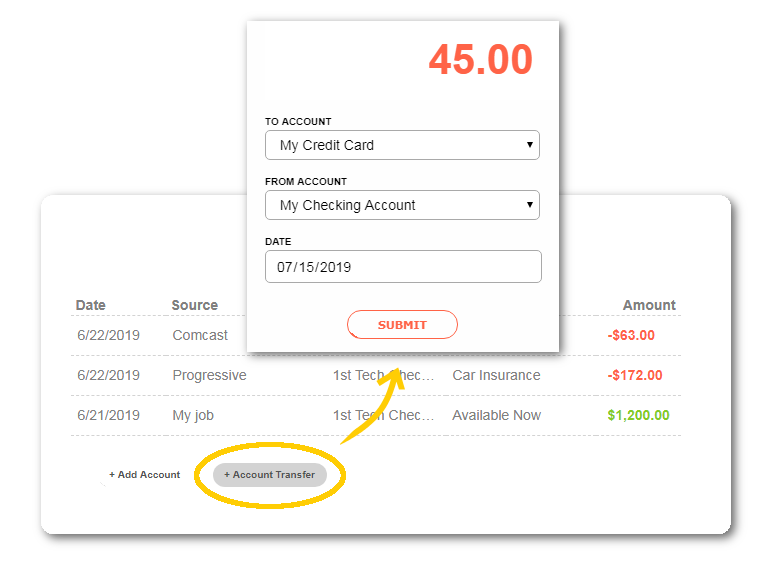

- When you make a payment, record it as an Account Transfer from your checking account to the debt account. This will update the balance of both accounts.

- If you keep using the credit card to make purchases, categorize future expenses under their appropriate budget category – Food, Shopping, etc.

The Good: You will see the balance decrease over time, which can be motivating.

The Bad: Payments are recorded differently from other transactions. The debt account will also appear as an account option when recording income and expenses.

Additional Interest & Fees

If you’re using an account to track your debt, you can record additional interest and fees as expenses when they occur to update the balance of your debt.

If your payments are less than the interest and fees, you will owe more and more money over time despite your payments.

Don’t ignore it!

No matter how you track it, you should check on your debt at least once a month to make sure you understand the interest and fees being charged. Double check that your payments are being recognized by your lender.

Debt is easy to ignore. It may be difficult to get started, but once you build the habit of checking on your debt - the fear will subside and you'll have more control over your situation.

Bonus: Debt Polyomino Tracker

Want a fun way to track your progress?

We made a special Polyonimo Tracker for your debt! When making your monthly payment loses its sparkle, you can look forward to coloring in another square or two and keep the payoff train going.

Related Posts

How To Get One Month Ahead

Case Study: Valerie