Choose Your Debt Strategy: Snowball vs. Avalanche

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

When it comes to paying off debt, there are two key methods that make up about 99% of the advice. The Snowball Method and the Avalanche Method.

You’ll want to choose your plan of attack with several factors in mind:

- Paying off debt ASAP

- Minimizing interest and fees

- Staying motivated

Either way, your debt should be a part of your budget. Learn how to track it in Vermillion!

Debt is often seen as a personal failure, making it hard to address emotionally. So before we dive into the strategy, let’s get one thing straight.

Pre-Requisite: Ditch the shame.

Look, I’m not a fan of the typical diatribe you’d read from Dave Ramsey, Suze Orman, or most other financial gurus. They lather up words like “debt” and “credit” with enough shame to make you want to quit before you start.

Is that helpful?

Or does shame keep you from taking action?

We all have debt.

In 2015, 80% of Americans had debt. And that was freaking 2015.

- People take out small business loans to bring their ideas into the marketplace.

- People incur medical debt because they’re in need, not because they’re lazy or stupid.

- People take out student loans to afford an education.

I know people who took out credit card debt and borrowed against their 401(k)’s to pay for food.

In fact, the biggest source of debt in this country is the mortgage, which is often seen as a way to build wealth. I’m not saying we should mock the American dream of home ownership - I’m saying we have a strange filter when it comes to what constitutes “good debt” and “bad debt”.

Sometimes we choose debt.

Sometimes we don’t.

So let’s ditch the shame and Kon Mari that debt – thank it for it’s purpose, and get on with getting rid of it.

Snowball Method (Smallest Balance First)

This is the most common strategy that gets thrown around. It’s usually touted by the financial gurus who cater mainly to middle-class Americans with low financial literacy. It works best if motivation is the biggest problem.

- Make minimum payments on all debts as required.

- Direct all additional payments towards the debt with the smallest balance.

- Once that is paid off, direct all additional payments to the loan with the next-smallest balance, and so forth.

The Good: You will get earlier psychological wins by paying off individual debts in their entirety sooner, simplifying your payments earlier.

The Bad: You pay more in interest compared to other methods, because you may be leaving the highest-interest items for last. It could take you longer to pay off everything.

This method works best when you have a lot of different loans to pay off, and you need to simplify the landscape quickly.

It also works well if you’re having a difficult time emotionally addressing your debt.

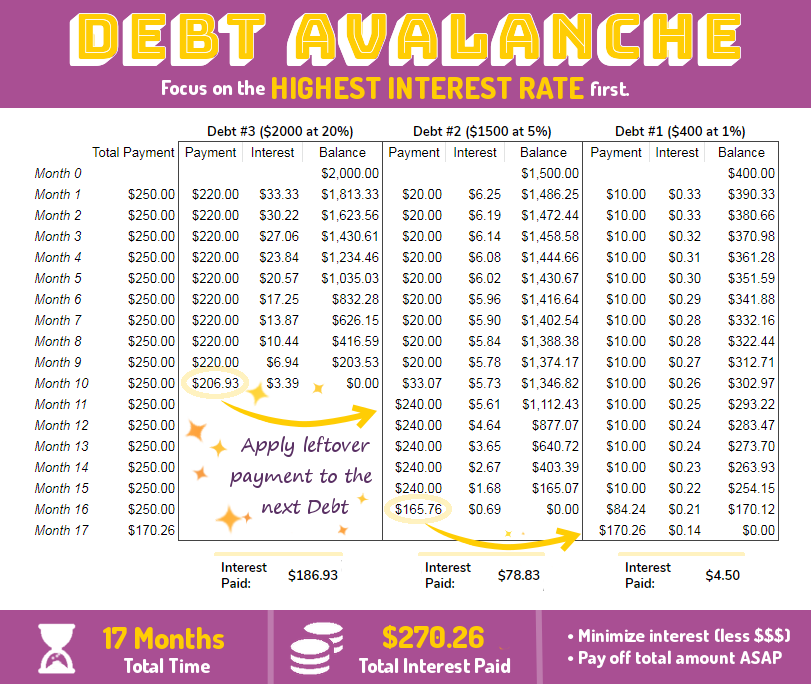

Avalanche Method (Highest Interest Rate First)

This strategy is the natural response to the Snowball Method. Instead of focusing on the lowest balance, you focus on the highest interest rate.

Because you pay interest on each debt for as long as you have it, you’ll pay more in interest the longer you keep the debt around. The higher the interest, the more you’ll pay.

Not all debt is created equally.

The Annual Percentage Rate (APR) tells you how much you’ll pay in interest and fees every year. Even though they might have different lifetimes, the APR helps you compare apples to apples.

| Debt | Average APR | Debt | Average APR |

|---|---|---|---|

| Mortgage | 4.39% | Credit card | 17.73% (as high as 30%) |

| Student loan | 5.05%-7.6% | Payday loan | 400% (as high as 780%) |

Here’s how to tackle your debt using the Avalanche Method.

- Make minimum payments as required.

- Direct all additional payments towards the debt with the highest interest rate.

- Once that is paid off, direct all additional payments to the loan with the next-highest interest rate, and so forth.

The Good: You’ll minimize the total amount paid over the lifetime of the debt (including interest and fees), and thus pay off everything sooner.

The Bad: It can be a long and grueling process before you manage to cross the first item off. It can feel like you’re just throwing money in a black hole that never goes away.

This method works best if you have some seriously high-interest debt, like a payday loan. For most situations, it makes the most sense on paper if you want to finish sooner and minimize the interest and fees.

Which should you pick?

The answer is: It doesn’t matter.

The secret is to pick one debt and focus on paying it off as quickly as possible. Staying motivated is more important than the interest you’ll save, because it will help you keep going when things get rough. But if you can tough it out, you’ll save money in the long run by tackling your highest-interest debts first.

Other Tactics

To turbo-charge your debt repayment, there are a few more things you can do.

Classic advice involves maximizing your payments through some combination of cutting costs and increasing income. Take a close look at your budget to determine what you can slash. Side jobs and extra hours can bring in more cash to boost your payments.

Here are some other tricks to consider.

1. Refinance your debt.

Since your interest rate determines how much you’ll pay, you may want to consider refinancing. Sometimes called debt consolidation, this entails paying off old debts with a new loan from another vendor. The new loan will typically have:

- Lower interest rate (saving you $$$)

- One payment (simplifying your finances)

- Bonus just for signing up (toward the balance of the debt)

Here my three favorite refinancing options (I looked up the current rates for this post):

|

So-Fi

|

LendKey

|

CommonBond

|

|

|---|---|---|---|

| Loan type | Student & Personal | Student | Student |

| Lowest Variable Rate | 2.41% APR | 2.38% APR | 2.43% APR |

| Lowed Fixed Rate | 3.49% APR | 3.64% APR | 3.36% APR |

| Origination Fees | — | — | 2.0% |

| Other Perks | Free career coaching, no-fee investing | Possible 1% APR reduction after paying off 10% of balance | Pays for education of a child in developing nation |

| Get $100 off | Get $200 off | Learn more |

Your new interest rate will be based on a host of criteria (loan type, length of time, credit history, etc.) with lowest rates usually reserved for student loan refi’s. Every institution also has their own unique qualifying criteria that you’ll have to meet.

But if you do, you could score a much lower interest rate and a sizeable bonus towards the balance. What have you got to lose?

2. Ask friends or family for a loan.

Similar to refinancing, you may consider asking someone you know for a loan, and using that money to pay off your debts.

If you have a good history with them, they may be willing – even eager! – to help you. And they’re often willing to do it interest-free.

Even if it doesn’t cover the entire balance of your debt, it will reduce the amount of money you spend on interest and fees which – as we covered – will hasten the pay down process.

3. Throw away your emergency fund.

This one is risky. Make sure you have adult supervision.

If you have a hefty emergency fund, you may consider dipping into it to pay off some of your debt. You should be extra stable (housing, job, etc.) before you attempt this.

This only works with small debts. You need to be able to build your emergency fund back up quickly. Before you try this, make sure you have a clear plan for how to handle unexpected expenses.

4. Buy lottery tickets.

Just kidding. I really don’t recommend this. Unless you’re a mathematician.

Which will you choose?

No matter how you tackle it, the best thing to do is to start. We can’t wait to see you pay down your debt and start building towards your goals!