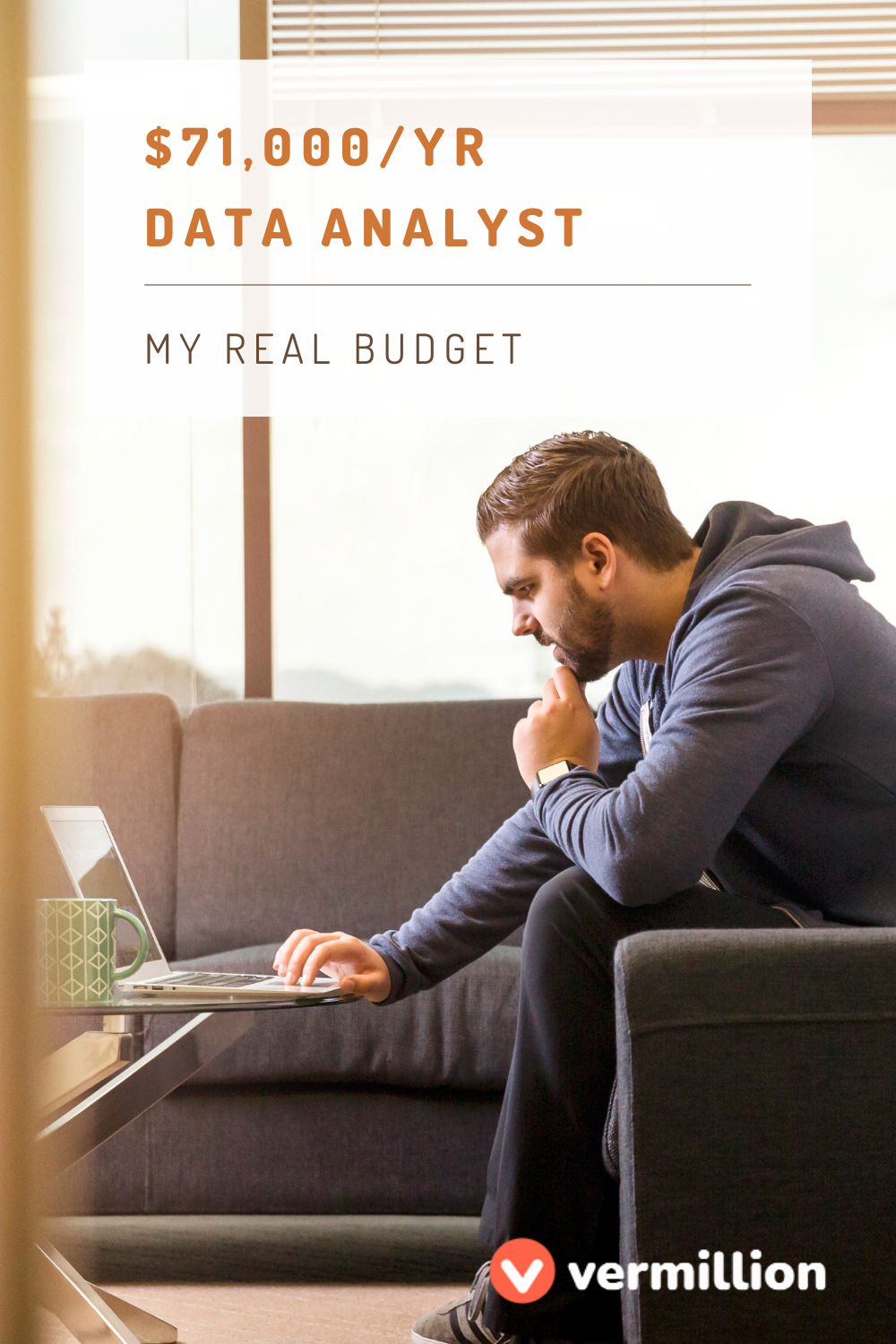

Case Study: George

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Welcome to our third case study!

George is a 27-year-old Data Analyst working in the Silicon Forest. Six months after graduating with a STEM degree, he found a job that uses his technical skills – and it’s been up and up ever since!

Now that he’s settled into his growth trajectory, he’s looking to plan his budget as thoughtfully as his career. Let’s start with some month-to-month info.

Occupation: Data Analyst

Location: Portland, OR

Age: 27

Annual income: $71,000/yr

Typical paycheck: $1755, every other week.

George says:

For the first time in my life, I make more than enough to cover everything that matters. I’m even off my family’s phone plan! I enjoy the philosophy of having fun while I’m still young, but I also want an optimized savings plan. I know homeownership is a good investment, so that’s my current goal. I also put money into retirement, at least a couple hundred every month – it’s automatic through my work, enough to get the company match.

Biggest concerns: Balancing debt and savings.

Biggest goals: I’m saving up to buy a house in the next 5 years.

Most proud of: I give very thoughtful gifts. I keep a stash of money in case I find the perfect thing to buy someone.

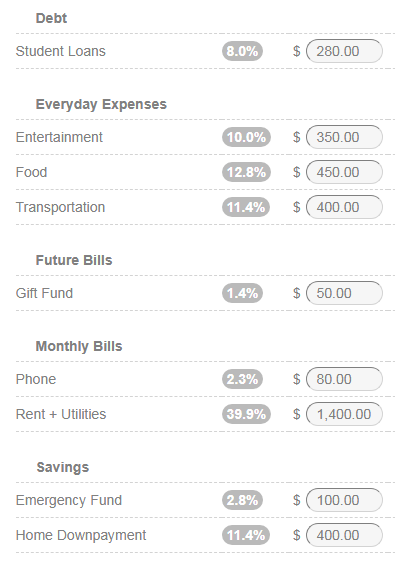

Student Loans

Making the minimum payments easily, not really worried about this since I can afford it.

Transportation

My car is pretty month-to-month. I also have a TriMet monthly pass, and I take the occassional Uber or Lyft.

Home Downpayment

Currently saving $400/month, but I’d like to save up at least 5% of the home cost – likely around $20,000. At my current rate it will take me about 4ish years to save up enough, which is perfect for my 5-year goal.

You seem to be focused on saving more, but what’s missing from your approach is spending less. When savings is an afterthought, you’ll find that you are able to afford a lot of things – but for some reason you’re not saving very much…

This is because you can’t afford to do both. You can save a lot or you can spend a lot - but not both. In fact, you could accomplish your downpayment goal in under a year if you made significant cuts to your spending in other areas.

You’re very fortunate to make a lot of money for someone your age, but you need to be careful not to let lifestyle inflation get the best of you.

Let’s dig into that budget to see how much we can save.

Transportation

Firstly, even if you take public transportation every day the Hop Pass will be a better deal than a monthly pass. Just remember to set it on auto-load for $100 (or less!) every month and you’ll never notice the difference.

It looks like you might have a monthly car payment. If you do have a monthly payment, simply sell your current costly vehicle and buy a reliable used car in full. A quick Craiglist search turns up a bunch of Toyota Camrys for under $3,000 – a solid choice.

Don’t forget to also shop around for cheaper insurance, too! It will generally cost less to insure a cheaper car, so the savings will compound. We previously wrote about shopping for car insurance here. Tl;dr: check out Root Car Insurance and get $25 off with our referral link.

But I have to wonder… If you live and work in the city, do you need your car? Plenty of people go car-less in Portland. In fact, selling your car and relying on public transportation could free up over $250/month – or 7.1% – of your budget.

Let’s assume you ditch the car and reduce your Uber/Lyft consumption by increasing your use of public transportation. That should bring you down to about $180/month.

Additional savings: $220.00

Food

Cooking for one? You don’t mention children or a culinary addiction.

If it’s just you, you should be able to keep your food costs under $200/month. I’ll do a more in-depth post on this, but here are some quick tips:

- Bring your own lunch to work.

- Cook meals at home.

- Limit restaurants and bars with friends to 1x/week maximum.

Some cheap staples include eggs, cabbage, and carrots. You can add in some rice, beans, or pasta for filler. If one egg costs about $0.06, then a 3-egg scramble for breakfast would be only $0.18 – why pay over 50x the price just to eat in a loud diner?

Additional savings: $250.00

Entertainment

There are so many things you can have fun doing for free!

My entertainment budget is $50/month, but I’ve been told I’m no fun. A reasonable budget might be $100-$200 at the maximum, but I would aim for $100 and opt to increase it once every couple months for special occasions like concerts.

This can be a tough category for a lot of people to cut. Instead of focusing on what you can’t do (e.g. a concert, a destination wedding, clubbing), focus on things you can do. Try some free activities instead like exploration walks, concerts in the parks around town, or a picnic!

This might mean changing who you hang out with, since your current friends may not like your new activities. This can be a great opportunity to deepen friendships with people you don’t see often, or make some new friends!

Additional savings: $250.00

Loans

It’s usually a mistake to settle for making the minimum payments on your debt. This will prolong the life of your loan and you’ll end up paying more in interest and fees over time.

Even though it’s more fun to focus on your homeownership goal, I’d divert your savings temporarily and focus on knocking out your debt. Based on what you could be saving, this could actually be a pretty fast process for you.

If you have multiple loans, you’ll want to pick the best strategy to minimize interest and maximize motivation. We’ve covered how to choose the best strategy here.

In that post we also cover refinancing, which could get you:

- Lower interest rate (saving you $$$)

- One payment (simplifying your finances)

- Bonus just for signing up (toward the balance of the debt)

But you’ll want to be careful with student loans specifically, as refinancing could cause you to lose any special eligibility for repayment plans.

Once you pay this off, you can add that 8% back into your savings rate. Win!

If you’re wondering how to include your debt in your budget, check out our recent How-To about paying down debt in Vermillion.

Additional savings: $280.00

Phone

This is small potatoes, but I’d be remiss not to mention that you can do better. When you stop buying the latest iPhone and switch to a bare-bones phone plan you should be paying no more than $40/month. I’ve seen as cheap as $25/month through Mint Mobile.

Additional savings: $55.00

More, more more…

If you’re looking for extreme measures, I’d suggest changing your living situation. There are definitely cheaper places to live in Portland – especially if you’re willing to live with a roommate. Simply changing your housing situation could save you as much money as all of the changes we’ve discussed so far.

This can be a big change to consider, but given that housing makes up nearly 40% of your budget, it’s worth thinking about.

Adding It Up

There’s a lot of opportunity here to save more. The easiest budget to streamline is one with high income and lots of discretionary spending. Simply trim down the discretionary spending and use that money towards more cost-cutting endeavers – like a cheaper car.

Total Additional Savings: $1055.00

Old Savings Rate: $500/$3,510 = 14.2%

New Savings Rate: $1,555/$3,510 = 44.3%

If you’d like to share your budget with our readers, email us at hello@vermillion.app. We’d love to hear from you!