Should You Focus On Repaying Debt Or Investing?

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Spoiler alert: Paying down debt is hugely important. This is not complicated.

But investing is also important – esepcially if you want to maximize your net worth over the long run. So mathematically speaking, is there an optimal combination of paying down debt and investing?

Yes!

Is it unequivocally the right path for everyone?

Hell no!

But you should know it anyway.

A Dream Deferred

It’s not hard to see that people are entering the workforce with more debt than ever. With higher burdens, it’s no surprise that debt follows folks around for much longer, too. This means many people wait longer to start investing, until they manage to pay off their lingering debts.

Yet we know that it’s vitally important to start investing early and often.

Are these people making a huge mistake?

The Optimal Combination

Assuming your goal is to maximize your net worth, the solution is simple. In fact, it’s so simple, you probably won’t believe me.

But I’ve crunched the numbers.

Ready?

Put your money where the interest rate is higher.

Not buying it? I’ll illustrate with some examples.

Example #1

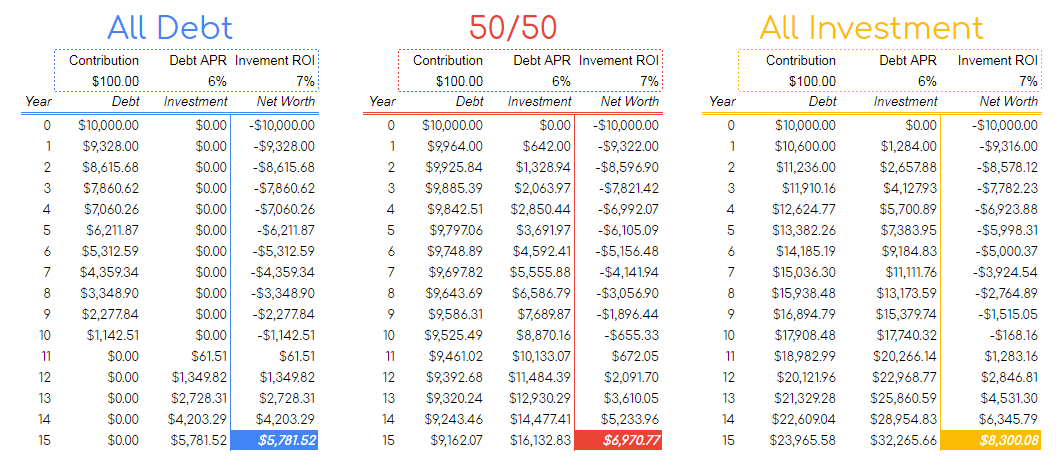

Let’s say you have one loan with a balance of $10,000 and an interest rate of 6%. Similarly, let’s say you can get an average return of 7% in the stock market. To keep things simple, both funds compound annually, and all fees and penalties of the loan are included in that 6%. If you pay nothing, it just increases in size by 6%.

Assume you have $100 every month to put towards your net worth. Nice!

Should you…

A) Pay down $100 of debt

B) Pay down $50 & invest $50

C) Invest $100

Over 15 years, we can see a big difference in the performance of each strategy.

The resulting net worth after 15 years:

A) Pay down $100 of debt ➡ $5,781.51

B) Pay down $50 & invest $50 ➡ $6,970.77

C) Invest $100 ➡ $8,300.08 Winner!

After 15 years of ignoring your debt and investing all your money, your net worth is $8,300.08!

Even though the balance of your loan in Option C balloons to a whopping $23,965.58, your investment swells to a comparable $32,265.66. Since your investment is growing faster than your debt, you can easily pay off the loan and pocket the difference.

But the net worth of Option C isn’t just higher after 15 years – it’s higher every year in between. That means that no matter how long- or short-term your goals, this strategy holds up. Same goes for bigger or smaller contributions.

Example #2

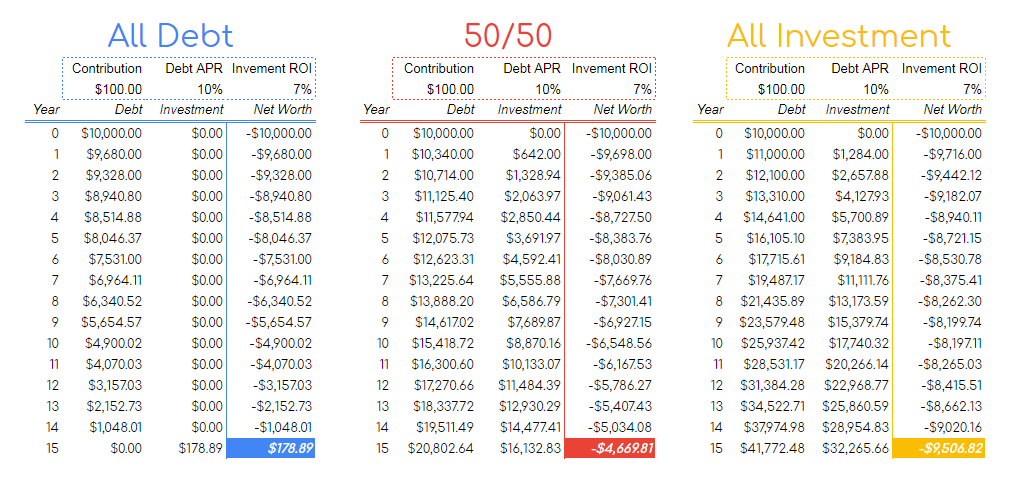

Now let’s change one key variable – your loan’s interest rate. Assume it’s 10% instead of 6%. Everything else is the same.

Net worth after 15 years:

A) Pay down $100 of debt ➡ $178.89

B) Pay down $50 & invest $50 ➡ -$4,669.81

C) Invest $100 ➡ -$9,506.82 Yikes!

This looks a whole helluvalot different, doesn’t it?

In this case, your debt is growing much faster than your investment. This is also where compound interest starts to matter a lot. After 10 years you can see the additional interest you accrue on your loan starts to outpace your investments.

This is the start of a downward spiral, and likely to end in bankruptcy. In this case, it’s much better to focus on Option A – pay down that debt ASAP!

In Practice, It’s Not So Simple

Even if investing seems more lucrative, debt usually has a stronger emotional component. If it keeps you motivated, it may do more for your bottom line to pay down debt than to invest. It also provides a nice and clear finish line to strive for.

To make matters worse, different debts amortize at different rates, making it hard to estimate interest rates accurately. Student loans, for example, actually accrue interest daily. Yes, daily.

Debt is often seen as a personal failure, making it hard to address emotionally… When it comes to paying off debt, there are two key methods that make up about 99% of the advice. The Snowball Method and the Avalanche Method.

Choose Your Debt Strategy: Snowball vs. Avalanche

Investments can also be pretty volatile, and you’re almost never guaranteed a specific rate of return. It’s usually a good idea to focus on investment as a long-term strategy. But there are simple ways to get started.

Nowadays, you can get started for as little as $5. In fact, you can get started for free.

Which is better: Saving or Investing?

What’s your plan?

The best strategy will depend entirely on your individual circumstances, but you can rely on some key takeaways:

- Focus on eliminating high-interest debt first.

- Don’t ignore investing if your debt is low-interest.

- Motivation is a key factor in continued engagement.

So what’s your strategy?

Related Posts

Case Study: Valerie

Case Study: Jess