Debt-Free By December

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Those of us behind the Vermillion blog are excited to aggressively tackle one of the biggest vampires sucking the life-blood out of our fellow budgets: Debt.

But this isn’t just any blog post.

We put together a star-studded action plan – nay, challenge! – for finally defeating your debt for good.

This is not for the faint of heart. This challenge is about paying down your debt as quickly as possible. This year, we’re aiming high.

The goal is to pay off 100% of your debt in 2020.

Consider this a Debt Detox.

I can hear you doing the mental arithmetic in your head:

“I make $$$ before taxes, but my paycheck is only $$, then after rent and groceries I have…”

Stop.

Before you weigh yourself down with all the can’ts and won’ts, dare to set your sights on what you really want.

Even if you only accomplish 80% of your goal (or even 30%!) you’ll still be building discipline and habits that will continue to serve you in all your future endeavors.

When the goal comes first, you will find resources you never knew existed.

There are only two magic bullets that erase your debt:

- Bankruptcy

- Death

…and the first one doesn’t even cover student loans. YIKES.

This action plan has been streamlined and power-packed so that you won’t even believe your own progress when 2021 rolls around. Trust me, I’ve been there.

The highlights are thus:

- Maximizing your payments

- Minimizing interest

- Maintaining motivation to continue

So without further ado, let’s get down to brass tacks.

Pre-requisite: Ditch the shame

Before you begin your total transformation, take a minute to acknowledge the factors contributing to your situation that are outside of your control.

- Your past

- Your limitations

- The actions of others

While you may have some influence over how these things affect you, it's usually more effective to focus on things within your locus of control – such as:

- The job you have

- The food you eat

- The services you pay for

- How you spend your free time

Kon-Mari Your Debt

Recognize the benefit that this debt afforded you when you took it on. Did it pay for an education, or provide a roof over your head?

People don’t get into debt because they’re stupid or lazy – they are making a choice based on their circumstances, and life is very often stacked against the most vulnerable.

Forgive yourself for the choices you made, and resolve to move forward.

Maximizing your payments

The fastest way to pay off your debt is simply to throw as much money as humanly possible at the problem.

Here are the non-negotiable steps to turning your budget on its head in order to wring every last dollar out:

- Make a budget and record your spending

- Pay yourself first, last, and in-between

- Look for ways to cut costs and slash spending

- Bring in a little extra

If you’re already considering skipping any of these steps, you may not be ready for this challenge.

I did say this wasn’t for the faint of heart.

1. Make a budget and record your spending.

Do I even need to say it? This is the best way to really, truly squeeze every last penny out of your paycheck. This is the one step which will really make every other step more effective.

DO NOT SKIP THIS.

Don’t rely on a service to log your expenses for you. Applications like Mint make it easy to check your spending patterns at a glance, but do little to encourage real awareness and engagement.

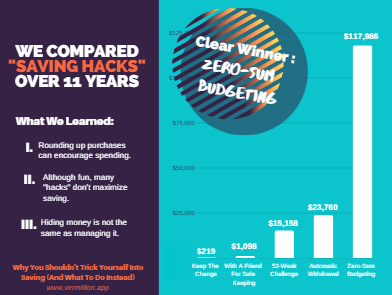

The Perfect Savings “Hack”

The Perfect Savings “Hack”

We compared different savings methods and found a clear winner – zero-sum budgeting!

It was 5x more effective than the next leading strategy.

Why You Shouldn’t Trick Yourself Into Saving

Aim to record every dollar yourself – by hand, if necessary. Remember: This is a commitment that pays off in cash.

2. Pay yourself first, last, and in-between.

Don’t just use what’s leftover at the end of the month.

Be proactive! Be reactive! Read more about this strategy in our previous post:

Look online and you’ll see tons of totally different advice:

-Set up automatic withdrawals.

-Round up each expense and save the change.

-Have an app take small amounts of money out of your accounts at random times.

-Save every $5 you find. Yes, really. This is a thing.

I take a different approach.

First, Last, And In-Between

3. Look for ways to cut costs and slash spending.

A budget makes this easy.

…well, easier.

Here are some items to consider:

- Jump on the Buy Nothing bandwagon. Look up your local Buy Nothing group on Facebook.

- Re-evaluate your insurance (home, auto, other)

- Eat cheap, cheap meals (no more snacks, no more buying lunch at work, no more delivery).

Our next post will go into detail about how to demolish your grocery budget. But for now just focus on only buying food from the grocery store. That is the #1 way to save money on food – even if you buy the fanciest pre-made food available.

- Limit driving and transportation

- Downgrade or eliminate vacations and planned trips

This one is tough to hear. But that $2,000 annual vacation is keeping you from your #debtgoals. Try to recognize your internal defensiveness kicking in and stay open to the idea of trying something new – aka: a no-spend-cation.

- Need more? Submit your budget for a case study or sign up for personalized budget coaching for just $5/month.

4. Bring in a little extra.

Please don’t download those rewards apps, inbox scanning programs, or answer surveys in your spare time. Unless that’s your passion.

If you're serious about making some side-money, you need to be conscious of ROT - Return On (Your) Time. Think of it like ROI (Return on Investment), but for your free hours and labor.

Avoid multi-level marketing and apps that just want to sell your data in exchange for pennies. If it sounds too good to be true… it probably is. You need to be thinking bigger than dollars and cents.

Before you commit your labor to a service or company, do a little due diligence first.

- Google search "[Company name] scam" and read the first page of results.

- If it won’t make you at least $20/month, don’t bother.

- If it requires an investment of more than $100, write it down and come back to it when you’re not in debt.

That might cross a lot of things off your list, so here are some ROT-ful (get it? like thoughtful??) suggestions:

- Sell things from your home – appliances you don’t use, extra furniture. Focus on things of real sellable value, not clothing and pantry items.

- Take on a side-gig – make sure it pays!

- Take in a roommate.

- This is the least exciting, but possibly most effective option.

- Pick up a part-time job.

- Again, really unappetizing but potentially hundreds of dollars.

- Think about the ROT: 4 hours a week at $10/hr will net $160 before taxes. That’s not a lot, but it is $160/month more than you have right now.

- Accept help from friends and family.

Now is the time to put your pride in the back seat. Maybe you have some skills that can be put to use – babysitting, art, cleaning, organizing. Tell your community what you’re trying to accomplish and offer a reasonable rate.

Just don’t waste your most valuable resource – your time.

Minimize the interest

The best way to minimize interest is to pay off your debt as quickly as possible. (We were serious about maximizing your payments.) Most debt only accrues interest as it sits around waiting to be paid.

This means the faster you kill it, the less interest will accrue.

1. Use the Debt Avalanche.

You’ve heard of the Debt Snowball. The Debt Avalanche is similar, but focuses on paying off high-interest debt first.

This minimizes the interest you’ll pay and will optimize your paydown plan to get you out of debt faster.

- Make minimum payments as required.

- Direct all additional payments towards the debt with the highest interest rate.

- Once that is paid off, direct all additional payments to the loan with the next-highest interest rate, and so forth.

Choose Your Debt Strategy: Snowball vs. Avalanche

2. Consolidate – if it makes sense.

If you can knock out the highest-interest debt first, definitely do that. But if your highest-interest debt is also the largest balance, you may want to consider refinancing.

Sometimes called debt consolidation, this entails paying off old debts with a new loan from another vendor. The new loan will typically have:

-Lower interest rate (saving you $$$)

-One payment (simplifying your finances)

-Bonus just for signing up (toward the balance of the debt)

Choose Your Debt Strategy: Snowball vs. Avalanche

And don’t forget to include your debt in your budget!

Maintain motivation

The hardest thing about debt is that it’s a marathon – not a sprint.

You need to build accountability so that you can still execute the plan, even when you don't feel like it. That means you need to confront the icky, uncomfortable part of your debt – telling others.

1. Track, record, measure!

It is literally impossible to know your progress unless you are recording numbers somewhere. You should already be tracking your budget and spending, but you should also be meticulously tracking your debt balance.

Not sure where to start?

Record the following each week:

- The total you paid off that week

- The ending balance

- The % paid off / left to go

The simple act of recording it will make you want to take action. You’ll want to see that number MOVE.

2. Set SMART-V goals

Once you’re tracking your progress, you’ll want to set milestones to make sure you’re keeping pace with your goals. They can also serve as incentive for a little extra push.

When setting new goals, the SMART-V framework is tried-and-true:

- [S]pecific: Objective numbers yield better success than subjective judgements.

- [M]easurable: Stick to dollar amounts or clearly defined percentages so that you know where you stand.

- [A]chievable: Be realistic - but don’t be afraid to be ambitious if it suits you!

- [R]elevant: Make sure your goal fits into your vision of a happier, healthier future.

- [T]ime-Sensitive: Set a time limit to reach your goal by. If you’d like to meet your goal within 12 months, you can work backwards to figure out what you need to do each month to succeed.

But what does the V stand for?

The V stands for VERMILLION!

Just kidding, it stands for VISIBLE. There are tons of debt trackers out there. Pick one, print it off, and go to town. Just make sure you hang it somewhere in your line of sight, preferably not in competition with other papers and visuals.

Some suggestions:

- Right next to the TV. (Weird, right?)

- Over the kitchen sink.

- Next to where you keep your keys.

- Taped to your bedroom mirror.

- In front of the toilet.

- All of the above (get creative).

And if you get bored – print off another one! Or make a paper chain, or a giant thermometer. Just make sure it’s easy to update.

3. Join a community

It’s hard to sustain effort alone. A community of people focused on the same flavor of goals will not only help you stay accountable – they can support you when things get rough.

Financial stress is incredibly isolating – and counterproductive. Humans are social creatures – we learn best when we learn together. And guess what? You’re probably already doing it.

Finding Your Financial Community

4. Celebrate your wins!

Set milestones and achieve them! Make sure these are aligned with your SMART-V goals, and focus on positive reinforcement.

While I think a goal achieved is its own reward, you might find a movie date or new shoes to be more motivating. Pick something small relative to your debt and make sure it’s purely enjoyable.

If you achieve it, you’ve earned it!

You didn’t tell me how long it will take, how much to contribute, or–

Every situation is different.

Honestly, I don’t care how much you make, or spend, or owe. My advice is going to be the same: Pay down as much as possible, as quickly as possible.

Every click-bait article claiming, “We paid down $50,000 in just 6 months!” has one thing in common:

They paid $50,000 in 6 months.

Maybe they paid $8,400 every month. Maybe they paid $100/month for 10 months, and then sold their house for a tidy profit. It doesn’t matter.

The only thing that matters is your budget, because it is your debt.

But what if you’re already #debtfree?

Most of these steps can be applied to any financial goal.

- Maximize the good thing (your contribution)

- Minimize the bad thing (aka maximize ROT)

- Stay the course

Do you have any lofty goals for 2020? Let’s see you tackle them!

Related Posts

Case Study: Valerie

5 Steps to Early Retirement for Single Moms