First, Last, And In-Between

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

We all know we should be saving more, but sometimes it feels like squeezing blood from a stone.

Look online and you’ll see tons of totally different advice:

- Set up automatic withdrawals.

- Round up each expense and save the change.

- Have an app take small amounts of money out of your accounts at random times.

- Save every $5 bill you find. Yes, really. This is a thing.

I take a different approach.

To really know you’re saving as much money as possible, you have to know what you’re spending. To know your limits, you can't set your savings on auto-pilot.

Wouldn’t that be just too easy?

In my quest to wring every last cent out of my budget and into my savings, I’ve tested most of these methods – and I’ve found a system that works better than all of them.

You may have heard people say, “Pay yourself first.”

Well, I prefer to pay myself first, last, and in-between.

Pay Yourself First

You know this one.

This is the time-tested wisdom of setting aside a chunk of money with every paycheck before you can spend it. You portion it out first-thing, hence paying yourself first.

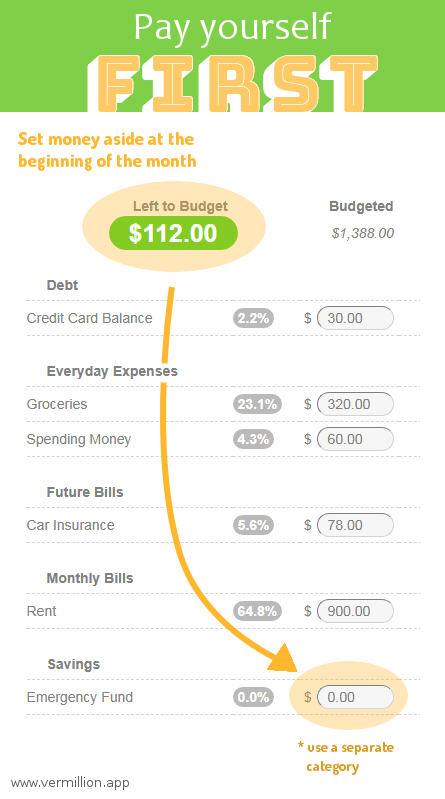

When you set up your monthly budget, put some money towards that savings category! It doesn’t have to be a lot.

Baking this into your budget from the beginning helps cement your commitment to your goal.

You’re more likely to protect this money if you know what it’s for.

It’s good advice.

It’s just not the whole story.

Pay Yourself Last

This one is pretty simple – and the most common.

It’s also the laziest.

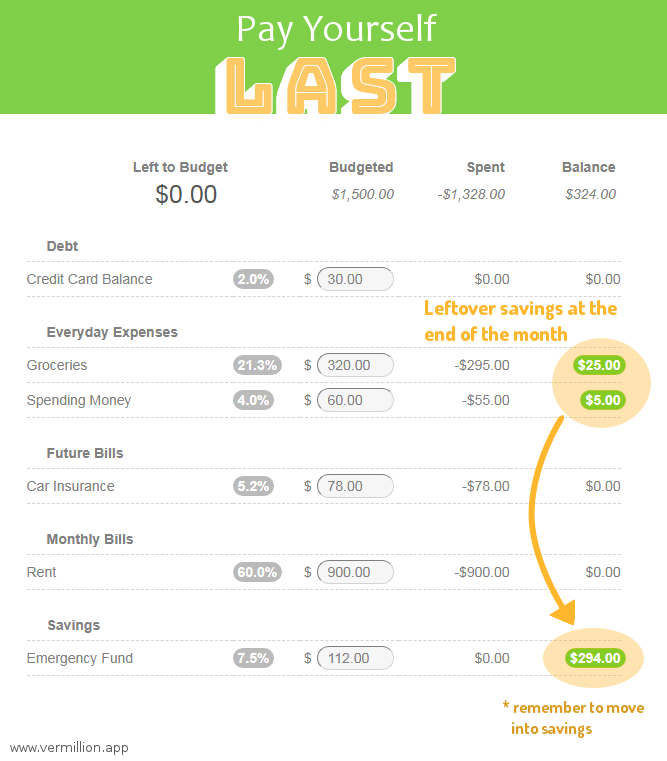

Most people consider "saving money" to be whatever is leftover at the end of each month, and this is precisely how they do it.

At the end of the month, take a look at any categories with money left over. Take out that extra money and add it to your savings category!

This works well for people who make plenty of money and aren’t prone to spending it all. It’s the easiest, but least effective method – but still an important part of a balanced breakfast budget.

The bottom line: Money left lying around at the end of the month doesn’t get saved unless you move it into savings.

Pay Yourself In-Between

This is it.

This is where the magic happens.

This is my own budgeting secret.

This method goes beyond automation, because it relies on my focus and attention to detail. And it really adds up.

If you’re like me, you know what things cost. You know when you’re getting a good deal. For example, I know roughly how much I spend every week at the grocery store. You might know how much your daily coffee or lunch special is. So when you spend a bit less, you know roughly how much you’ve saved.

But what happens to that money? Is it still there at the end of the month?

Is it really “saved”?

Or does it ultimately just get spent on something else?

As soon as you notice savings, move it out of the spending category and into savings. In order to truly save it, you need to move it out of your spending pool. If you need it, you can always move it back.

That’s it.

I’ve found this to be approximately 10,000x better than automated saving apps for the following reasons:

- It's not random. I’ll never risk an overdraft fee, because I know exactly what I have and what I’m moving around.

- It's more than pocket change. If I save $10, I know it – and I can take action immediately!

- It rewards saving, not spending. Automated apps rely on spending behavior to trigger savings. This incentivizes spending, which is the exact opposite of what you want.

But the benefits of this method go beyond dollars and cents. It keeps me vigilant about what I’m spending and critical of promotional offers.

Remember: Coupons and promotions are a marketing gimmick.

They offer low prices on things you wouldn’t buy anyway, like name brand items and luxury products.

If I’m spending more money, I’m probably not saving more money. I always say, "You know what's cheaper than a discount? Not buying it."

In Conclusion

Even if you’re not struggling to make ends meet, it can be hard to know if you’re saving enough money.

Apps and automations can only show us patterns in our spending, but they rarely push us to our limits. Give these methods a shot and try paying yourself first, last, and in-between.

Related Posts

Case Study: Valerie

How To Budget While Broke