Case Study: Nick

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Welcome to our second case study!

Today we’ll hear from Nick: a 33-year-old burning the candle at both ends. While working full-time as a material handler in a warehouse, he also works nearly 40 hours/week at his “part-time” at a fast food chain. Let’s start with some month-to-month info.

Location: Vancouver, WA

Age: 33

Job #1: Warehouse Material Handler (40 hrs/week)

Annual income: $22,500/yr ($11.38/hr)

Typical paycheck: $660, every other week.

Job #2: Fast Food Worker (36 hrs/week)

Annual income: $23,700/yr ($12.00/hr)

Typical paycheck: $700, every other week.

Nick says:

I make barely above minimum wage, but that’s gone up a lot since I first moved to Vancouver. I remember when I was only making just over $9/hr. Unfortunately everything has also gotten more expensive, too.

Honestly I make enough money, but something catastrophic always seems to happen that wipes out my savings. Old debt pops up out of nowhere and they take all the money out of my bank accounts – my car needs something fixed (which I need to get to my jobs) – my parents need help with something. It never ends.

Biggest concerns: Saving enough for an emergency.

Biggest goals: Make more money. If I get a promotion, I might go down to only one job.

Most proud of: Losing weight! Since moving out here, I’ve lost at least 60lbs.

Food

I get a discount at my job, so I try to eat at least one meal/day there – but I usually pick something pretty healthy, like a chicken breast with vegetables. I buy everything else at CostCo.

I also really enjoy going to different bars around town, usually once or twice a week. I don’t have a ton of spare time to do much else.Old Debt

When I moved out to the West Coast, I really didn’t want anything to do with the money I owed. I was young, and I didn’t know what I was doing.

Since then I’ve had my savings wiped out a few times by collections, so I try not to keep all my money in one place. I know I need to be more proactive, so I’ll sit down and make a plan soon.Rent

I get a really good deal on a room right now. This could go up in the future, though. I’m used to renting rooms in shared houses, so I think I’ll be fine.

First of all: Congrats on your weight loss journey! That same planning and determination will help you get your finances in shape, too.

Let’s go over some categories to see if we can help.

Tackle insideous debt

Unchecked debt can really cut into your plans for the future. It’s great that you want to settle it once and for all!

Next week’s post will go into much greater detail about debt paydown strategies. If you’re eager to include your debt in your budget, check out our recent How-To about debt in Vermillion.

Separate food and entertainment

While grocery food and restaurant food are related, tracking them separately can be eye-opening. It’s no secret that a $15 meal can be made at home for under $5. This lesson compounds over the course of a month, especially if you’re going out every week. Here’s a guess at how it would look as two categories:

Grocery - $170

Bars & Restaurants - $215

Engineered to spend

Bars, coffee shops, and shopping malls are money-traps disguised as hubs of social activity.

The trick to spending less is identifying the need they fill – and then finding another way to meet it.

I’m guessing bars provide a social outlet – especially useful if you’re feeling overworked. If it’s a regular part of your routine, you may need to experiment with some new habits to limit spending.

That doesn’t mean you need to stop bar-hopping, though.

Limit your time

The best way to limit your spending at a bar is to limit your time there. The longer you spend at money traps, the more likely you are to buy another drink or some food. Setting a time limit can prevent overspending.

If you’re meeting friends, you can suggest going to someone’s house or the park instead.

Limit your consumption

A simple tactic is to drink less. Commit to a 3-drink maximum, order water in-between, or eat before you arrive – you’ll have even less reason to order food. You can also try a cash-only method. When the bills are gone, the drinks stop.

No matter how you approach it, this category can be drastically reduced. But you should expect a slight increase in your Grocery spending to offset it. Groceries are much cheaper than bar food, though.

Grocery - $210

Bars & Restaurants - $40

Additional savings: $135.00

Car Insurance

I always recommend shopping around for car insurance. A few minutes of research can save you tons of money in the long run.

If cutting out lattes is low effort/low reward, think of cheaper car insurance as low effort/high reward. Or better yet: one-time-effort/recurring reward - the savings just keep rolling in with no additional work required.

There is a wealth of insurance companies on the market now that take advantage of technology to save you time and money. (They’re called insurtech – it’s a real thing!)

For example, Root Insurance claims to save good drivers as much as 52% on their car insurance. In fact, I’ve never seen a policy quite like theirs.

Rather than relying on demographics like gender and age, Root uses factors correlated with safe driving (braking, speed of turns, driving times, and route consistency) to determine your eligibility. Safer drivers require fewer insurance claims, so Root is able to save a ton of money on payouts, lowering the overall cost of the insured pool – which means a lower rate for you!

Root Insurance Co. on Dibble.com

Root Insurance Co. on Dibble.com

The process is simple:

- Download the app and let it observe your driving.

Pro-tip: You can get $25 off with our referral link. - Root will give you a driving score based on the data it collects.

- Play it safe while Root is watching and you’ll be eligible for their lower rates.

Of course, there are tons of options out there – research them all!

You can also re-evaluate your current policy to see if you can save a few dollars. For example, dropping comprehensive coverage might make sense if your car is getting pretty old.

I would estimate that Nick could probably find a policy that’s closer to $80/month. It may not seem like a huge win, but once you update your insurance once you won’t have to do it again. Remember: one-time-effort/recurring reward.

Additional savings: $19.00

Adding It Up

The biggest impact will come from stabilizing Nick’s debt. After that, it should be easier to save a bit more.

Total Additional Savings: $154.00

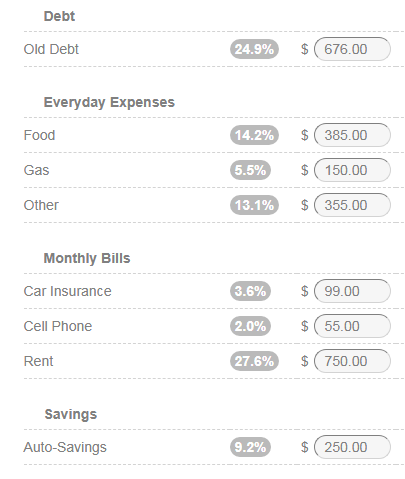

Old Savings Rate: $250/$2,720 = 9.2%

New Savings Rate: $404/$2,720 = 14.9%

Even a modest increase in savings rate can help you feel more in control of your money. You’ll have a larger cushion in case of emergencies – and safety is priceless.

If you’d like to share your budget with our readers, email us at hello@vermillion.app. We’d love to hear from you!