Why We Don't Save #5: "I don't have time to budget."

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Welcome to our series: Why We Don’t Save – a breakdown of the six most common reasons people put off starting their financial journey.

Are they legit? Do you feel personally attacked? Stay tuned for a new post in this series every month!

“You should sit in meditation for twenty minutes everyday - unless you’re too busy; then you should sit for an hour.”

― Dr. Sukhraj Dhillon

Sound familiar?

When you’re stressed for time, you don’t always make the best choices. But some activities are too important to cut for time.

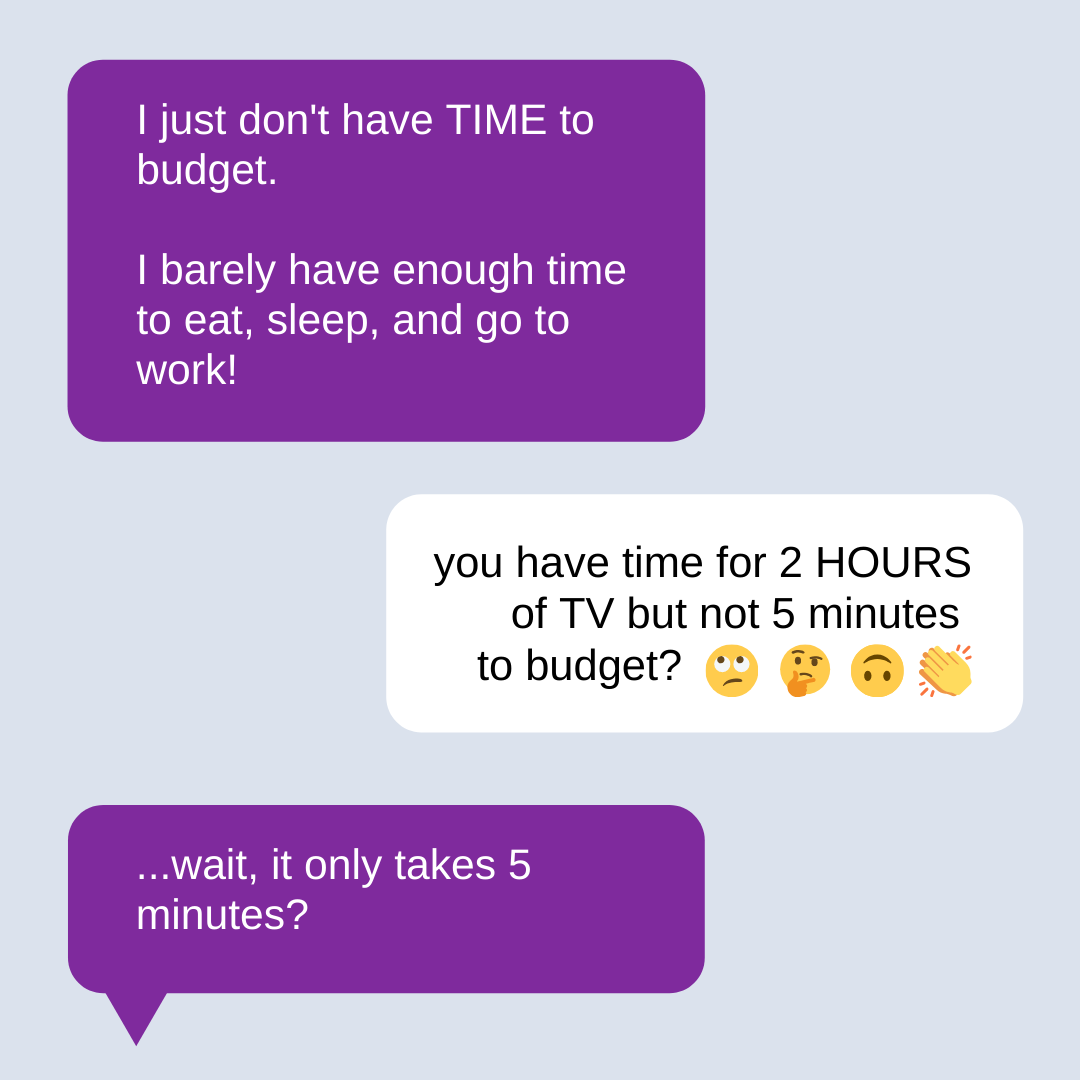

“I just don’t have time to budget. I’m already so busy – there aren’t enough hours in the day for me to sit down and record each and every little thing.”

― You, maybe.

The thing is, budgeting can save you time. If you’re burning the candle at both ends, you need every dollar working it’s hardest.

Without a budget, you might be wasting time and money. Can you afford not to have one?

Is it time – or energy?

You say you don’t have time to budget – but what you’re probably lacking is the energy.

- Physical energy – You’re too tired at the end of the day to do anything.

- Mental energy – Decision fatigue is creating a mental fog, making it hard to focus on the task at hand.

- Emotional energy – You just don’t want to. Eating broccoli, making your bed, and brushing your teeth – you can get it done if you need to. Budgeting is no different.

The solution for each of these is the same.

Schedule your budget check-ins earlier.

The last item on your to-do list rarely gets done – so shuffle the tasks around and put budgeting at the top. Sit down and do a little as early as you can – whether that’s first thing in the morning or right after you get home from work. Dinner can wait 5 minutes!

Even if you can only do a little bit each week, the task will feel easier and faster over time.

Budgeting can save you time.

If you had a magic device that added 15 minutes back into your day whenever you used it – would you wear it out?

Well what if I told you: A budget can do that. Think about it.

More money won’t solve all of your problems – but it would probably solve most of them, right?

If budgeting helps you efficiently allocate your money, and tracking your expenses keeps you from mindlessly spending it – then you can afford pricier solutions.

It pays for itself – in hours and minutes, that is.

Let’s look at a few examples.

Convenience Meals, Delivery, Curbside Pickup

Cooking is a great way to save money – but delivery is a great way to save time. It’s expensive, though. The labor involved in food preparation is often what you’re really paying for.

Think about how much time is spent…

- Cooking the food

- Packaging the food

- Delivering the food

- Serving the food

- Eating the food (just kidding, please don’t outsource this)

Eating nothing but home-cooked meals is one of the oldest tricks in the frugal book. But options like ready-made meals, delivery, takeout, and curbside grocery pick-up are time-savers. They often come with some additional cost (see: labor), but sometimes honestly it’s worth it.

The truth is, it takes a lot of human labor to get that sandwich to the deli downstairs just so you can rush down and buy it at the last minute.

5 Ways To Slash Your Food Spending

Transportation

I take the bus to work – 45 minutes each way. Driving would take 15 minutes, but then I’d have to pay for parking and gas.

If spending 30 minutes each week on my budget helps me rearrange the money to pay for it, however - I've freed up an extra 2 hours every week!

Unfortunately it’s not a solid chunk of 2 hours – rather, a little bit of time every day. But you can use this however you want – read a book, meditate, or sleep in!

Retirement – The Ultimate Time Reclaimation

You know that soul-crushing job you spend over 8 hours/day at?

Real talk: When we’re honest about the time we spend preparing for, commuting to, and at work – it’s closer to 12 hours/day.

Yikes!

Now imagine if you didn’t need that job.

If you save enough money, this could be you! Early Retirement is gaining popularity, and more people are seeking out forms of financial independence. It’s not as far fetched as it sounds!

A high savings rate can cut decades off your retirement date. Reclaim that time!

Invest your time wisely.

“You gotta spend money to make money, kid."

― Some investment bro trying to sell me on his latest scheme.

As cheesy as it sounds – sometimes it’s true.

A small investment upfront can yield huge rewards. This is exactly how we invest our money – it’s also how we invest our time!

A little bit of planning can reduce the number of decisions (and mistakes) you need to make later.

How much is your time worth?

There are 24 hours in a day – how long do you expect budgeting to take?

Here’s how much time I spend on it:

- Setting up my budget - 5 minutes, once.

- Logging income and expenses - 5 minutes/day on average.

- Actually logging all of my expenses at the end of the month because I lied about doing step #2 - 1 hour/month.

In a 30-day month, that comes out to 2 minutes/day.

If budgeting helps me squeeze an extra $200 into savings - and it does - I'm making $200/hr back on my time!

When was the last time someone paid you $200 for an hour’s worth of work?

Don’t give Diderot your money!

Sometimes we actually spend more money on solutions that take more time. The Diderot effect can gobble up your time as well as your money.

Simply put, he wound up in a mountain of debt and threw the nightgown into a lake in despair. I don’t recommend it.

He even wrote an essay about it, hilariously titled, “Regrets for my Old Dressing Gown”, or “A warning to those who have more taste than fortune”…

The Diderot Effect

For example, a new car might sound like a great idea. But you’ll have to spend time researching, going to dealerships, changing over the title, registration, and insurance…

If you’re keeping a budget, you may realize you can’t afford the expense anyway! Not only have you saved yourself some money, but you’ve saved a ton of time, too.

The same goes for the following items. Upgrade with caution…

- Cultivating a new wardrobe.

- Lengthy home renovations. (Unless something is actually broken.)

- Expensive hobbies. (Magic: The Gathering and sports both fall under my ire here.)

Get started in 5 minutes.

Whether you commit to the long-haul or not, you’ll wish you started earlier.

So start now.

- Set up a budget.

- Enter any new spending or income as it happens.

- Choose a specific time each day to do this, to keep it simple.

- Some days you might need more than 5 minutes, and other days you might not need any time at all!

Have you managed to squeeze anything worth celebrating into your schedule? Make this your new habit for the month!

Related Posts

Why We Don't Save #4: "My partner won't budget."