8 Ways to Improve Your Personal Savings Rate

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Unless you’re born rich, the path to financial security begins with a healthy personal savings rate.

By saving a higher percentage of your income, you can build an emergency fund, reach your financial goals, and have a solid foundation for the future.

But where should you start?

- Pursue a higher paying job?

- Trim expenses?

- Look for other creative solutions?

Everyone is different, but hopefully one (or more!) of these 8 strategies will help you on your journey to financial stability.

1. Prioritize Expenses

To improve your savings rate, it’s essential to analyze and prioritize your expenses.

You have to know where the money is going!

Start by creating a budget and tracking your spending. Identify areas where you can cut back without sacrificing your quality of life. Consider reviewing your subscriptions, renegotiating bills, and eliminating unnecessary purchases.

By being mindful of your expenses, you can redirect more funds towards savings.

2. Increase Income

Boosting your income is another effective way to improve your personal savings rate.

Earn more – save more!

Explore opportunities to earn additional income, such as taking on a side hustle or freelance work. Consider leveraging your skills and interests to monetize your hobbies.

Additionally, investing in your education and professional development can lead to career advancement and higher earnings over time.

3. Automate Savings

One of the best ways to ensure consistent savings is to automate the process.

You can’t spend what you don’t see. (I hope!)

Set up automatic transfers from your checking account to a separate savings account or investment vehicle. By doing so, a portion of your income will be saved before you have a chance to spend it.

This simple step removes the temptation to skip savings and reinforces good financial habits.

4. Set Clear Savings Goals

Having specific savings goals can provide motivation and focus.

A destination can make the journey feel worth it.

Determine what you are saving for, whether it’s a down payment on a house, retirement, or a dream vacation. Break down your goals into smaller milestones and track your progress along the way.

Celebrate each achievement, as it will keep you motivated to continue saving.

5. Practice Mindful Spending

Mindful spending involves being intentional and conscious about your purchases.

Awareness is a powerful drug.

Before making a non-essential purchase, pause and ask yourself if it aligns with your priorities and values. Consider implementing the 24-hour rule, where you wait a day before making a significant purchase.

This allows you time to evaluate if it’s a wise use of your hard-earned money.

6. Build an Emergency Fund

An emergency fund is a crucial component of financial stability.

You won’t need to dip into debt or investments if you have money set aside for emergencies!

Aim to save three to six months’ worth of living expenses in a separate account. But every little bit helps, even if you can’st manage that much!

This fund acts as a safety net during unexpected events like job loss or medical emergencies, preventing you from needing to withdraw from long-term savings or going into debt.

7. Reduce Debt

High-interest debt can hinder your savings efforts.

Debt with an interest rate lower than inflation is not considered “high-interest”.

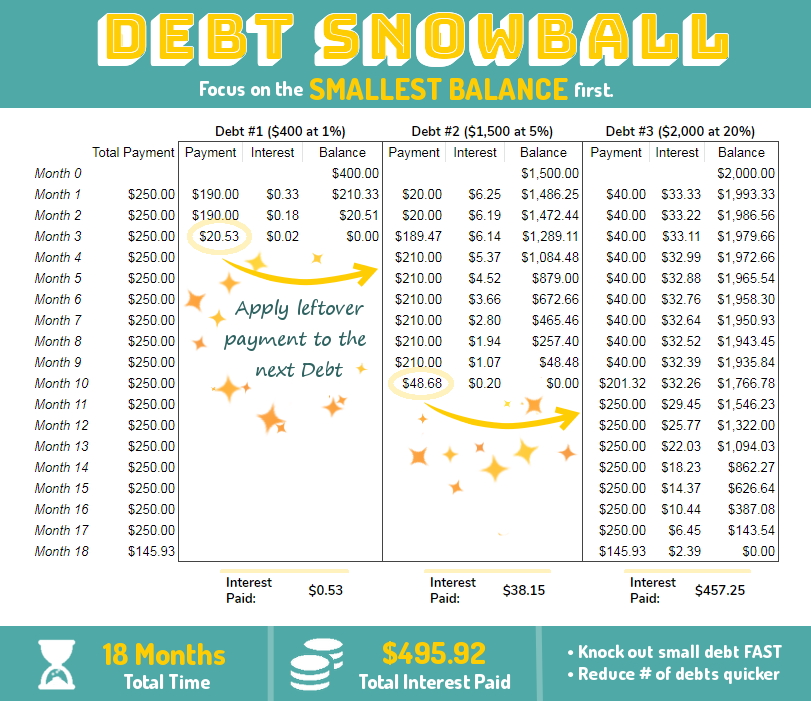

Prioritize paying off credit card balances, personal loans, or other debts. Develop a debt repayment strategy, such as the snowball or avalanche method, and commit to making consistent payments.

The Ultimate Debt Detox

We put together a star-studded action plan – nay, challenge! – for finally defeating your debt for good.

This is not for the faint of heart. This challenge is about paying down your debt as quickly as possible. This year, we’re aiming high.

Consider this a Debt Detox.

Debt-Free By December

The Perfect Debt “Hack”

The Perfect Debt “Hack”

When it comes to paying off debt, there are two key methods that make up about 99% of the advice. The Snowball Method and the Avalanche Method.

You’ll want to choose your plan of attack with several factors in mind.

Choose Your Debt Strategy: Snowball vs. Avalanche

As you eliminate debt, you will free up more money to allocate towards savings. Double win!

8. Maximize Retirement Contributions

If your employer offers a retirement savings plan, such as a 401(k) or IRA, take full advantage of it.

An employer match is 100% free money! So give yourself a raise.

Contribute at least enough to receive any employer matching contributions. Increasing your retirement contributions not only helps secure your future but also reduces your taxable income in the present.

Let’s Crunch Some Numbers

Spoiler alert: Paying down debt is hugely important. This is not complicated.

But investing is also important – esepcially if you want to maximize your net worth over the long run. So mathematically speaking, is there an optimal combination of paying down debt and investing?

Yes!

Is it unequivocally the right path for everyone?

Hell no!

But you should know it anyway.

Should You Focus On Repaying Debt Or Investing?

Improving your personal savings rate requires a combination of discipline, conscious decision-making, and strategic planning. By implementing these actionable tips and strategies, you can take control of your finances and make significant progress towards your savings goals.

Remember, it’s the small steps taken consistently that lead to long-term financial success.

Start today and embrace a savings mindset that will positively impact your financial well-being for years to come.

Related Posts

What Is A Personal Savings Rate And Why Does It Matter?