Finding Your Financial Community

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

You hate talking about money. I get it. You’d rather get a root canal. But if you’re serious about saving money, listen up.

You need to talk to somebody.

Financial stress is incredibly isolating – and counterproductive. Humans are social creatures – we learn best when we learn together.

And guess what? You’re probably already doing it.

It’s not about the money.

The dad talking about different schools for his children, the coworker discussing their new diet, or the friend mentioning her home repairs – it’s all money talk.

We actually discuss money all the time without realizing it – because almost everything in our lives ultimately comes down to money.

Depressing? Cynical? Maybe.

But hear me out.

Do your coworkers influence the type of lunch you eat at work (bought or brought)? Do your friends dictate your extracurricular activites? Does your partner have specific lifestyle needs?

It’s all money.

The rich get richer.

Rich parents are more likely to talk to their kids about currency, giving their children an undeniable edge in money matters. And it’s not just the talk when they’re old enough – it’s every age.

But not every school includes financial literacy. Finances are often lumped in with other “life skills” assumed to be taught at home. If your parents are good with money – that’s fine! But if you’re unlucky enough to be saddled with well-meaning but financially inept parents… you may be doomed to repeat them.

Does financial education work? It depends.

The most comprehensive meta-analysis of financial-literacy program evaluations, published in the journal Management Science in 2013, examined 168 papers covering more than 200 studies. It found that financial-literacy education was responsible for a 0.1% change in financial behaviors, like increased savings or reduced borrowing.(Washington Post)

Teaching a child about compound interest doesn’t always translate to an adult who understands their monthly mortgage payments. Especially when factors like more costly education/rent/health insurance and stagnating wages have changed the financial landscape.

Why We Don’t Save #1: “I’ll wait for a ’normal’ month.”

It’s enough to make a CPA cry.

As we get older our financial responsibility grows. Whether you’re off to college, starting your first job, or beginning to manage your household – every day can seem like a new struggle.

And this is when we start really building money habits.

Groceries, education, housing – most of us will look to our peers for cues without even realizing it. Our lifestyle is heavily influenced by our peer group, and it all costs money.

Smarter than the sum of our parts.

The internet has made it easier to compare prices, but some things are still shrouded in mystery – which ultimately puts you at a disadvantage.

When we talk to each other, we share information. The more information we have, the better informed our decisions (and spending!) will be.

This goes hand-in-hand with aligning our spending to our values, too. You can have the best values in the world – but if you don’t understand how things actually work behind the scenes, you could wind up causing more damage with your good intentions than if you’d stayed home.

For example, did you know that it’s much better to give money to food banks rather than canned goods?

No?

Well, now you do. Act accordingly.

How we spend our money is often a consequence of our lifestyles - but how we plan our money speaks volumes about our values.

5 Benefits of Budgeting That Have Nothing To Do With Money

Find your community.

So how do you start? Who do you open up to?

Start with your existing network – think family, friends, and coworkers. You don't need to list dollars and cents to talk about money. Just discuss what’s going on in your life, and you’ll gain some perspective – maybe even some well-deserved validation!

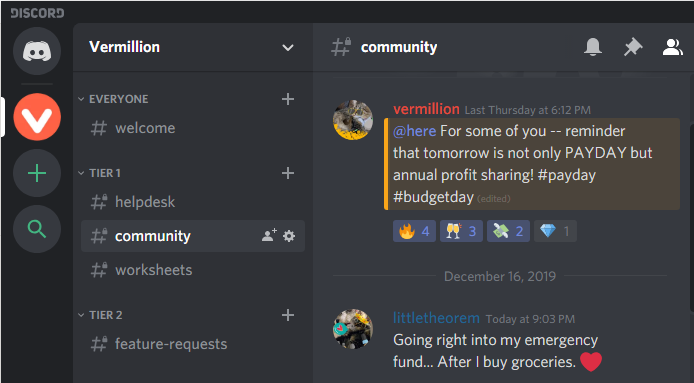

And if you’re ready to branch out and find a community of likeminded peers – join Vermillion’s Discord network.

We built a welcoming community for our members. Forgo one fancy barista coffee and drink at home with us instead! Come commiserate with other aspiring budgeters and reformed spenders in real time.

I promise we don’t bite.

Need a little more help?

We don’t always know the right people – sometimes we need someone with a little expertise.

But don’t worry – there are experts who will happily take your money. Should you pay $500 (or more) for a one-time meeting with a financial advisor?

God, I hope not.

Before you fork over your hard-earned savings, consider joining our $5/month plan for dedicated budget coaching. We’re here for you.

Find your community on Vermillion! Stay sane.

Related Posts

First, Last, And In-Between

13 Financial Self-Care Tasks