Case Study: Jess

We’re fortunate to earn money when you click on links to products or services we already know and love. This helps support the blog and allows us to continue to release free content. Read our full disclosure here.

Welcome to our fourth case study!

Today we’re hearing from Jess: a 29-year-old Routing and Logistics Specialist. Like most of us, she’s still multi-focused between her past and her future.

While she works hard to afford a good emergency fund and well-deserved time off, Jess still has student loans looming over her finances.

Occupation: Warehouse Routing & Logistics Specialist

Location: Portland, OR

Age: 29

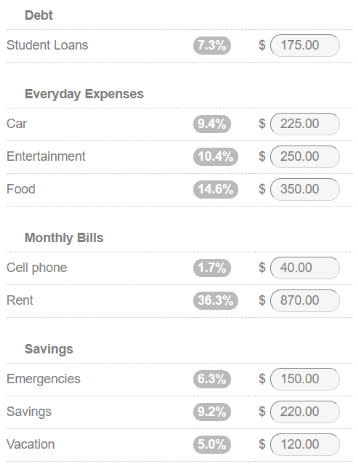

Annual income: $37,000/yr ($18.50/hr)

Typical paycheck: $1,200 every other week.

Jess says:

Thanks for checking out my budget! I currently work in a warehouse, coordinating inbound and outbound shipping. Ultimately I’d like to move up from my current position – to either better hours or more pay. Someday I’d love to be debt-free, as well.

Biggest concerns: My health is a big ongoing concern. I need health insurance, so I need a job. I can’t afford a lapse in coverage.

Biggest goals: Pay off my student loans.

Most proud of: I’m a pretty good cook, and I love bringing in food for my co-workers.

Vacation

Every year I try to take at least one trip somewhere. Usually I visit my family but lately I’ve been wanting to go somewhere new. If I didn’t save up for this in advance, I’d never be able to afford it.

Savings

I follow the First-Last-Inbetween method, actually! I do set aside a chunk of money in my original budget, and I usually sweep the leftover money into it at the end of the month (if there is any).

The hardest part is the in-between, because it’s not easy to know if I’m spending “less than usual” at random times during the month.Student Loans

I actually did refinance my student debt a while ago, but I didn’t realize it would extend the life of the loans. My payments were lower, so I didn’t realize I was actually paying off less than I would have been if I hadn’t refinanced. Mistake. I still have so much left…

Wow! It’s great that you’re saving so much of your budget. You’re already above a 20% savings rate, which is what most personal finance resources recommend.

Let’s dig into some of your concerns.

Savings: Pay Yourself In-Between

To master the in-between savings, you’ll want to build more awareness around your mid-month spending levels

There are two month-to-month options. If you shop on a regular basis (i.e. weekly or monthly) your expenses will be fairly regular.

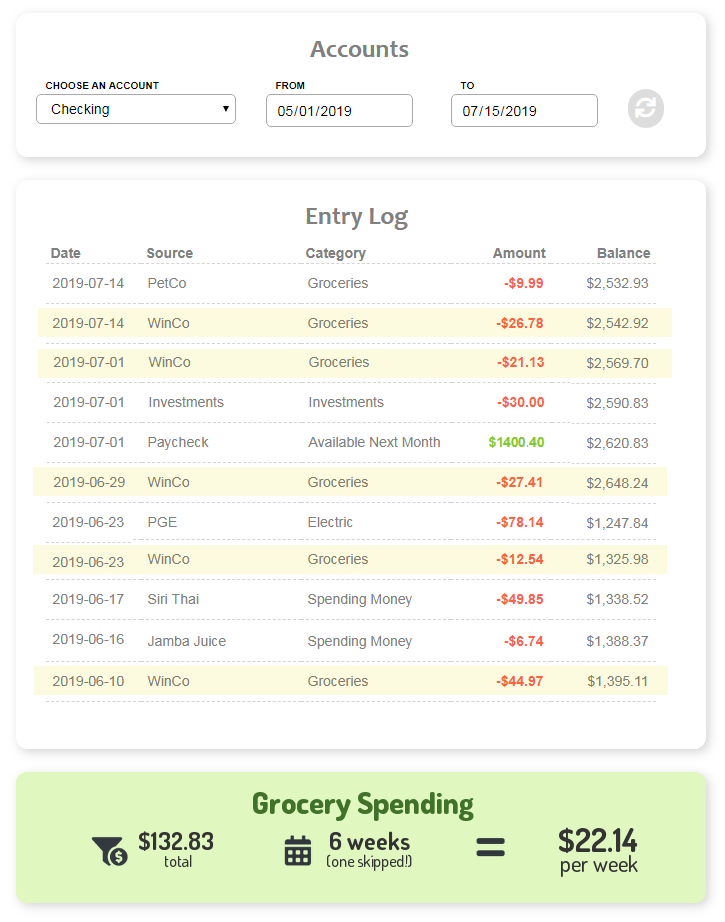

Take a look at your Accounts to see the transactions within a category to see what your spending range is.

For example, I spend between $20-$50 at the grocery store every week. So if I come home from my weekly grocery run and record only a $20 expense, I might decide to move an extra $10 from Grocery into Savings. When you know what you spend every week, you'll know when you're saving money.

You can also look at what you have left.

For example, if I have $80 left in my Grocery budget and two weeks left in the month, I might decide that I only need $60 for the rest of the month and move $20 into Savings.

If I end up needing it, I can always move it back. When you know how much you'll need, you'll know how much you can save.

With some closer attention, you should be able to take advantage of some mid-month savings, definitely at least $10. It’s not much, but it adds up.

Additional savings: $10.00

Student Loans

It sounds like you have some of the benefits of refinancing, but you’re not taking full advantage. Just because your monthly payment is low doesn’t mean you can’t contribute extra towards the principal. In fact, you should try not to decrease your payments unless absolutely necessary.

One last time, with emphasis: Always pay more than the minimum payment.

Paying off debt is simple – not easy.

To pay it off ASAP, you need to make larger payments. If you have multiple debts, you might want to choose the right strategy.

Either way, your “snowball” payments should get and stay as large as possible to pay off your debt as fast as possible. You’re saving quite a healthy amount, but if your debt is hanging over you like a dark cloud there’s nothing wrong with aggressively paying it off.

Looking at your budget, I fully believe you can do it!

And once you do, you’ll have a lot more to budget with.

Additional savings: $175

Car

If you’re commuting everyday, this is pretty reasonable. But you may still want to shop around for new car insurance, just in case you can get a better rate. Tl;dr: check out Root Car Insurance and get $25 off with our referral link.

You can also check out plublic transit options or supplement your daily commute with a bike day!

Entertainment

How much you’re willing to reduce this category will depend on how much you really want to save. If you want to save a lot, reduce it down to $20 (note: not $0).

If you’d only like to save a little bit more, reduce it to $200. Overall, I think $250 is a lot to spend on entertainment, but your situation is just that: Yours.

We’ll split the difference and set it at $75 so you have more to put toward your debt, vacation, or future planning.

Additional savings: $175

Adding It Up

Jess is already doing a great job saving a big portion of her paycheck every month. But with her current goals, she could stand to be saving a bit more. With some perseverance she should be able to pay off her debt and save even more for the things she loves.

Total Additional Savings: $360.00

Old Savings Rate: $490/$2,400 = 20.4%

New Savings Rate: $850/$2,400 = 35.4%

If you’d like to share your budget with our readers, email us at hello@vermillion.app. We’d love to hear from you!

Related Posts

Case Study: Valerie

8 Ways to Improve Your Personal Savings Rate